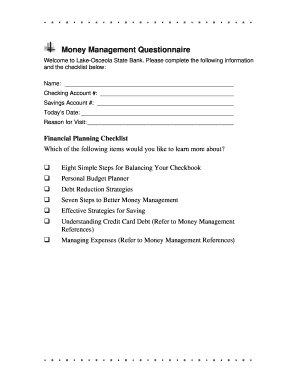

What is Family Budget Planner?

Families often find it challenging to manage their expenses and track their financial goals. This is where a Family Budget Planner comes in handy. It is a tool that helps families create a realistic budget and effectively manage their income and expenditures. By using a Family Budget Planner, families can gain more control over their finances and make informed financial decisions for a secure future.

What are the types of Family Budget Planner?

Family Budget Planners are available in different formats and variations to cater to the diverse needs of families. Some common types of Family Budget Planners include:

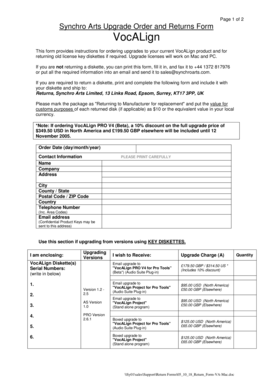

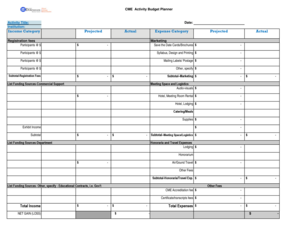

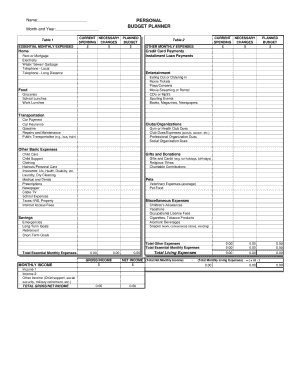

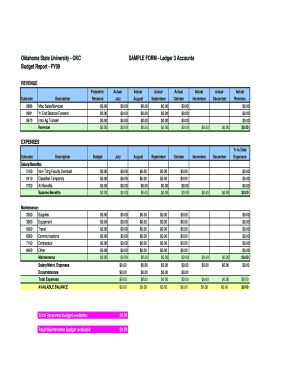

Spreadsheets: One of the most popular types of Family Budget Planners, spreadsheets provide flexibility in organizing and analyzing financial data.

Mobile apps: With the rise of smartphones, budgeting apps have become increasingly popular. These apps offer user-friendly interfaces and features that allow families to track their budget on the go.

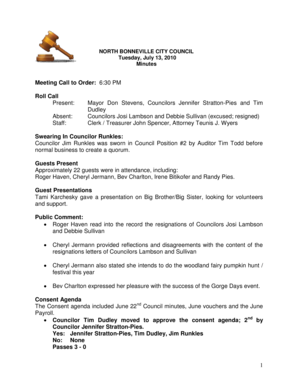

Online tools: Web-based budgeting tools, like pdfFiller, empower users to create, edit, and share their budget planners online. These tools provide convenience and accessibility, ensuring families can manage their budget from anywhere.

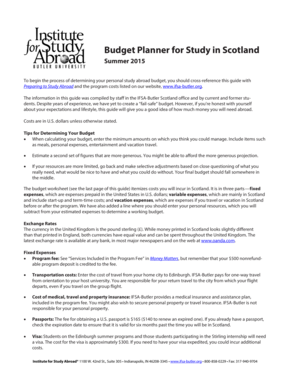

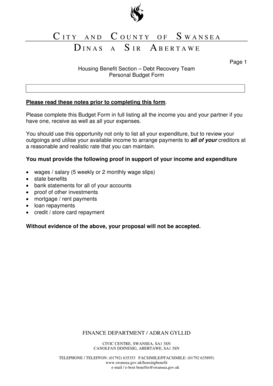

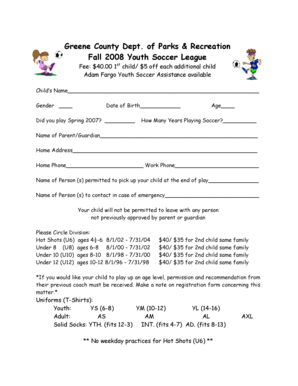

Printable templates: For those who prefer the traditional pen and paper method, printable budget templates are available for download and use.

How to complete Family Budget Planner

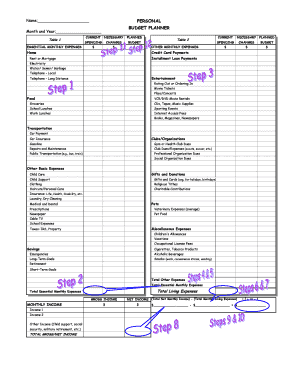

Completing a Family Budget Planner might seem daunting at first, but with the right approach, it becomes a simple and effective process. Here is a step-by-step guide to help you complete your Family Budget Planner:

01

Gather financial information: Start by gathering all your financial information, including income sources, bills, and expenses. This will give you a clear picture of your financial situation.

02

Set financial goals: Determine your financial goals, whether it's saving for a vacation, paying off debt, or building an emergency fund. Setting goals will help you prioritize your expenses and make necessary adjustments to your budget.

03

Track your expenses: Keep track of your daily expenses by recording them accurately. This will help you identify spending patterns and find areas where you can cut back or save.

04

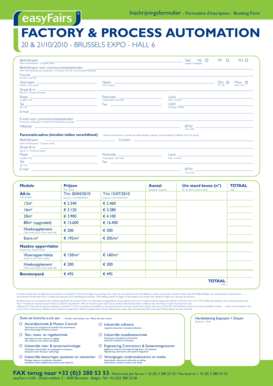

Categorize expenses: Categorize your expenses into different categories, such as housing, groceries, transportation, entertainment, etc. This will give you a better understanding of where your money is being spent.

05

Allocate your income: Allocate your income to different expense categories based on your priorities and financial goals. Make sure to allocate enough for essential expenses and savings.

06

Monitor and adjust: Regularly monitor your budget and make adjustments as needed. Life circumstances and financial goals may change, so it's important to adapt your budget accordingly.

07

Review and analyze: Periodically review your budget to analyze your financial progress. This will help you stay on track and make any necessary changes to ensure you achieve your goals.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.