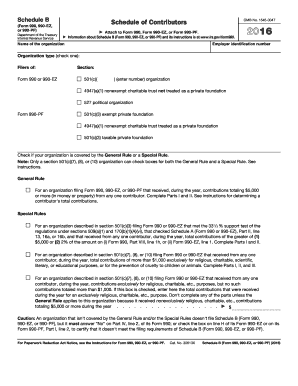

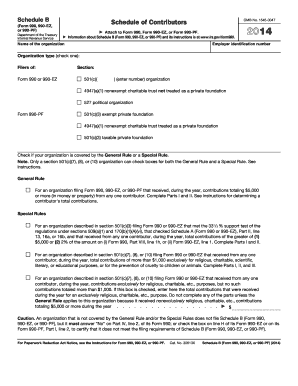

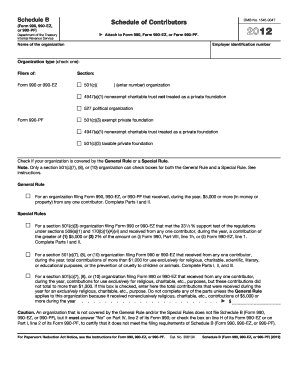

Schedule B (990 Form)

What is Schedule B (990 Form)?

Schedule B (990 Form) is a supplemental schedule that provides information on the contributions and grants received by an organization during the tax year. It is a requirement for tax-exempt organizations to report any contributions they receive, especially if they exceed a certain threshold. Schedule B helps the Internal Revenue Service (IRS) monitor and track the flow of funds into these organizations.

What are the types of Schedule B (990 Form)?

There are two types of Schedule B (990 Form): Schedule B Part I and Schedule B Part II. - Schedule B Part I: This section is used for reporting contributions received from individuals, partnerships, and corporations. It includes information such as the name of the contributor, their address, and the amount contributed. - Schedule B Part II: This section is used for reporting contributions received from foundations and other exempt organizations. Similar information is required as in Part I, but with additional details such as the grantor's identification number and the purpose of the grant.

How to complete Schedule B (990 Form)

Completing Schedule B (990 Form) can be done in a few simple steps: 1. Gather all the necessary information: Collect the details of all contributions received, including the name and address of the contributor, as well as the amount and purpose of the contribution. 2. Fill out Schedule B Part I: Enter the information for contributions received from individuals, partnerships, and corporations in this section. Ensure that all required fields are completed accurately. 3. Fill out Schedule B Part II: Enter the information for contributions received from foundations and other exempt organizations in this section. Provide all the necessary details, including the grantor's identification number and the purpose of the grant. 4. Double-check the information: Review all the entered information to ensure accuracy and completeness. 5. Submit the form: Once you have finished completing Schedule B (990 Form), submit it along with the rest of your Form 990 to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.