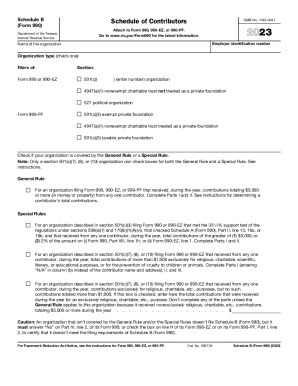

What is IRS form 990 Schedule B?

Form 990 Schedule B is a table of contributors attached with 990, 990-EZ, and 990-PF. This document provides information about the contributors and donations made to a tax-exempt organization.

Who should file IRS 990 Schedule B 2013?

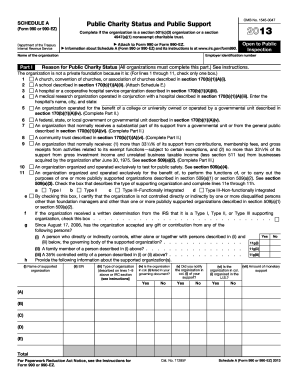

All organizations that file 990 or 990-EZ forms must complete and attach a Schedule B unless they can certify they don't meet the filing requirements of the document by checking Line H of 990-EZ. An organization filing this document can limit the contributors it reports on Schedule B using this greater-than-$5,000/2% threshold. But only if it checks the box on Schedule A (990 or 990-EZ), Part II, line 13, 16a, or 16b.

What information do you need in order to complete this sample?

It requires files to provide information about the corporate name, address, Employer Identification Number, and detailed information about personal, payroll, and noncash contributions. For more details about the content of this record, review the IRS instructions.

How do I file form 990 Schedule B in 2014?

The template consists of six pages. However, filers only need to fill out four of them. There are many data fields, so filling it out online instead of dealing with paper copies is easier. To prepare the document on the web, follow the guidelines below:

- Select the Get Form button at the top of this page.

- Enable the Wizard option from the top toolbar to avoid missing required fields.

- Indicate your organization's name and EIN in the fillable fields at the top of each page.

- Return to the first page and select the appropriate box to indicate what forms accompany this record.

- Check applicable boxes in the General Rules and Special Rules sections.

- Use Part I to specify contributors of your organization.

- In Part II, identify the non-cash property you’ve received.

- If required, fill out Part III.

- Select Done to close the editor.

- Download your document, Print it out, or Send it by email.

Is Form 990 Schedule B accompanied by other forms?

File the form along with 990, 990-EZ, and 990-PF forms.

What accounting method should be used for IRS 990 Schedule B?

Use the same accounting method checked on 990, Part XII, 990-EZ, line G, Financial Statements and Reporting line 1, and 990-PF, line J.

When is IRS 990 Schedule B due?

Since it must be attached to other forms, the due date is determined by the deadline for the 990 and the 990 EZ, which comes at the end of the organization's fiscal year. The organization must file the record by the 15th day of the 5th month after the end of the fiscal year (May 15th).

Where do I send Form 990 Schedule B?

Taxpayers should send this record as a part of a document package to the Internal Revenue Service Center (Ogden, UT 84201-0027).