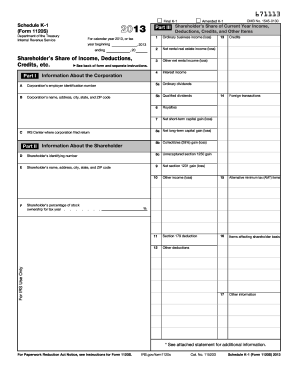

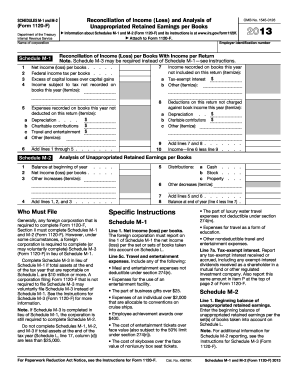

What is 2013 schedule a?

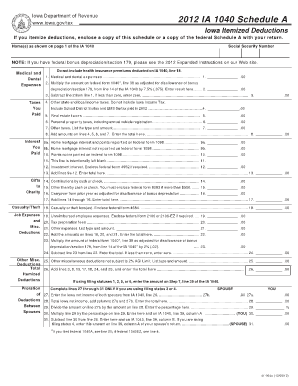

The 2013 schedule a refers to a specific tax form that individuals use to report itemized deductions. It is filed along with the individual's federal income tax return. This form allows taxpayers to claim deductions such as medical expenses, mortgage interest, charitable contributions, and certain miscellaneous expenses. By filling out the 2013 schedule a accurately, individuals can potentially lower their taxable income and reduce their overall tax liability.

What are the types of 2013 schedule a?

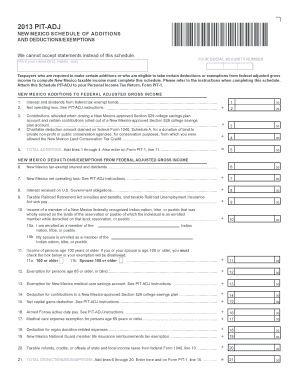

There are various types of deductions that can be claimed on the 2013 schedule a. These include:

Medical expenses: This deduction allows taxpayers to claim expenses related to medical and dental care, including insurance premiums and certain long-term care costs.

Mortgage interest: Homeowners can deduct the interest paid on their mortgage loans, up to certain limits.

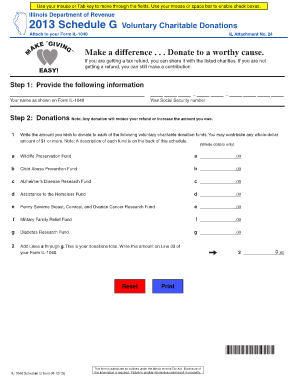

Charitable contributions: Donations made to qualifying charitable organizations may be claimed as deductions on schedule a.

State and local taxes: Taxpayers can deduct certain state and local taxes paid, such as income tax or property tax.

Miscellaneous expenses: This category includes deductions for unreimbursed employee expenses, tax preparation fees, and certain investment-related expenses.

How to complete 2013 schedule a?

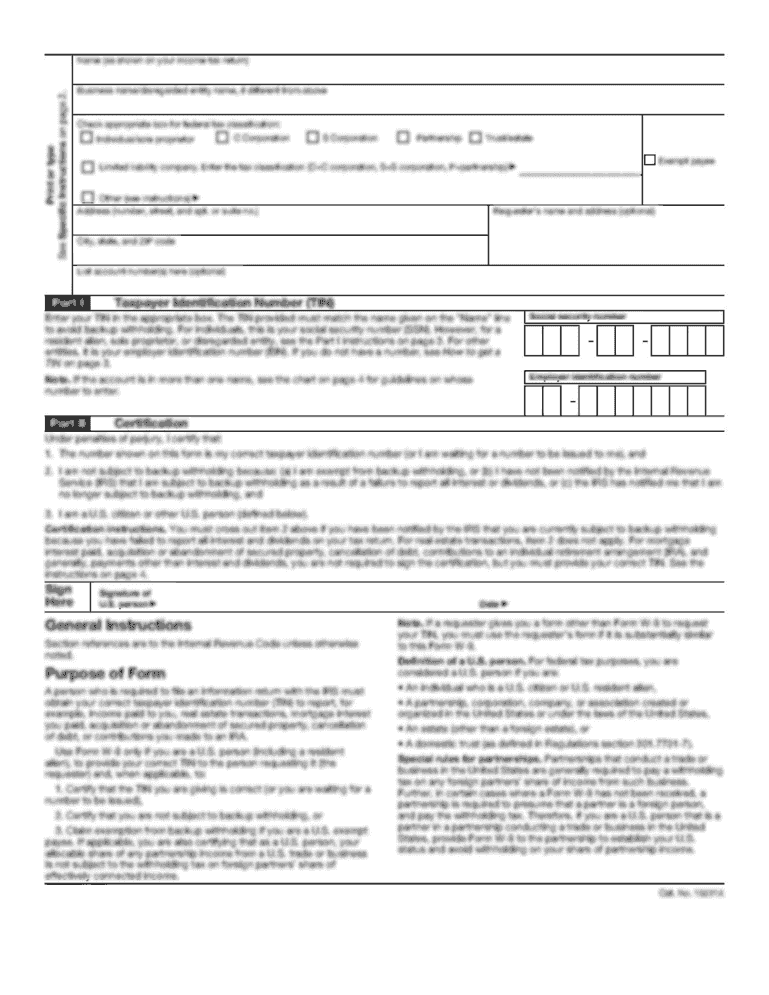

Completing the 2013 schedule a may seem daunting at first, but by following these steps, you can ensure accuracy and maximize your deductions:

01

Gather all necessary documentation: Collect receipts, invoices, and any other supporting documents for your deductions.

02

Fill out your personal information: Provide your name, address, and Social Security number.

03

Enter your income: Report your total income from all sources as required.

04

Calculate your deductions: Use the appropriate lines on the form to calculate your deductions based on the types mentioned above.

05

Review and double-check: Take the time to review your completed form for any errors or omissions.

06

Attach to your tax return: Once you have completed the schedule a, attach it to your federal income tax return before filing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.