2013 Schedule Se

What is 2013 schedule se?

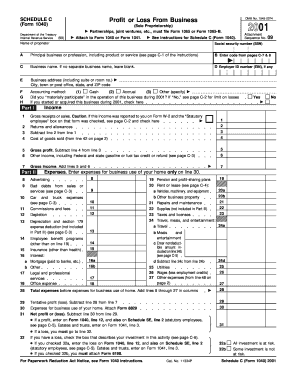

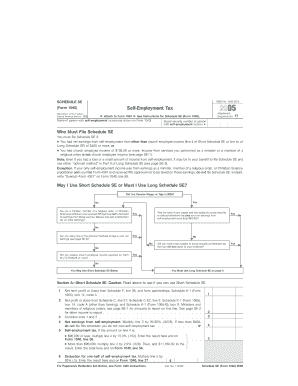

The 2013 schedule se refers to a specific form used by taxpayers who are self-employed or have income from other sources that require them to pay self-employment tax. This tax is used to fund Social Security and Medicare. By filling out this schedule, taxpayers report their self-employment income and calculate the amount of self-employment tax they owe.

What are the types of 2013 schedule se?

There are different types of 2013 schedule se, depending on the individual's specific circumstances. The main types include: 1. Schedule SE (Form 1040) - used by self-employed individuals who have a net profit of $400 or more from their business. 2. Schedule SE (Form 1040NR) - used by nonresident aliens who have a net profit of $400 or more from their business in the United States. 3. Schedule SE (Form 1040-SS) - used by U.S. citizens or resident aliens who are self-employed and have a net profit of $400 or more from their business in Puerto Rico or the U.S. territories.

How to complete 2013 schedule se

Completing the 2013 schedule se may seem daunting, but with the right information, it can be easily done. Here are the steps to follow: 1. Gather all necessary documents: Before starting, make sure you have all the required financial records, such as income statements, expense receipts, and records of self-employment tax payments. 2. Fill out personal information: Begin by entering your name, Social Security number, and other personal details as requested on the form. 3. Calculate your net profit: Determine your total income from self-employment and subtract any allowable deductions to calculate your net profit. 4. Determine your self-employment tax: Use the provided calculation method and the net profit amount to determine your self-employment tax. 5. Complete the rest of the form: Follow the instructions on the form to fill out the remaining sections, ensuring accuracy and thoroughness. 6. Include the form with your tax return: Once completed, attach the 2013 schedule se to your tax return before filing it with the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.