Get the free schedule se for 2007 form - irs

Get, Create, Make and Sign schedule se for 2007

How to edit schedule se for 2007 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule se for 2007

How to fill out schedule se for 2007:

Who needs Schedule SE for 2007?

Instructions and Help about schedule se for 2007

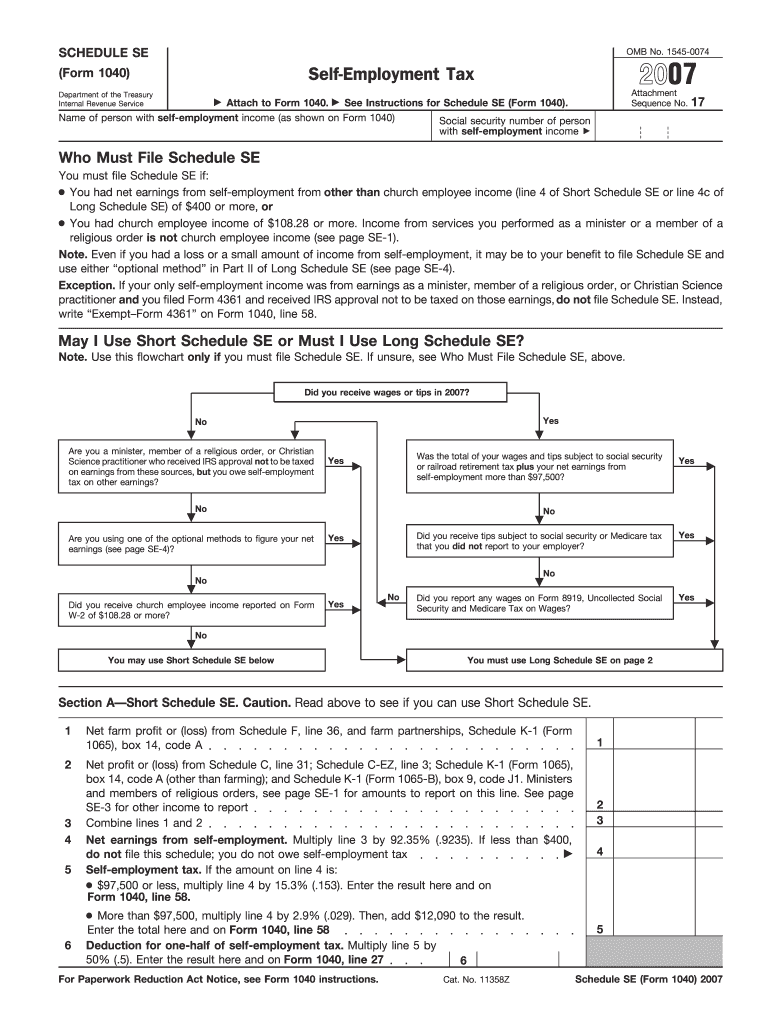

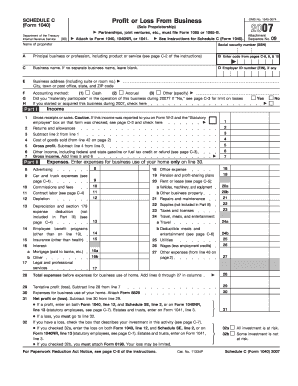

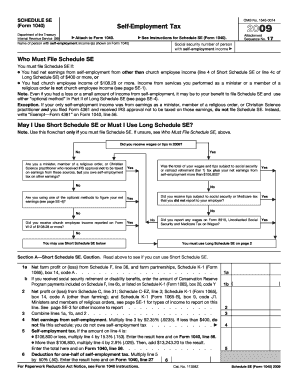

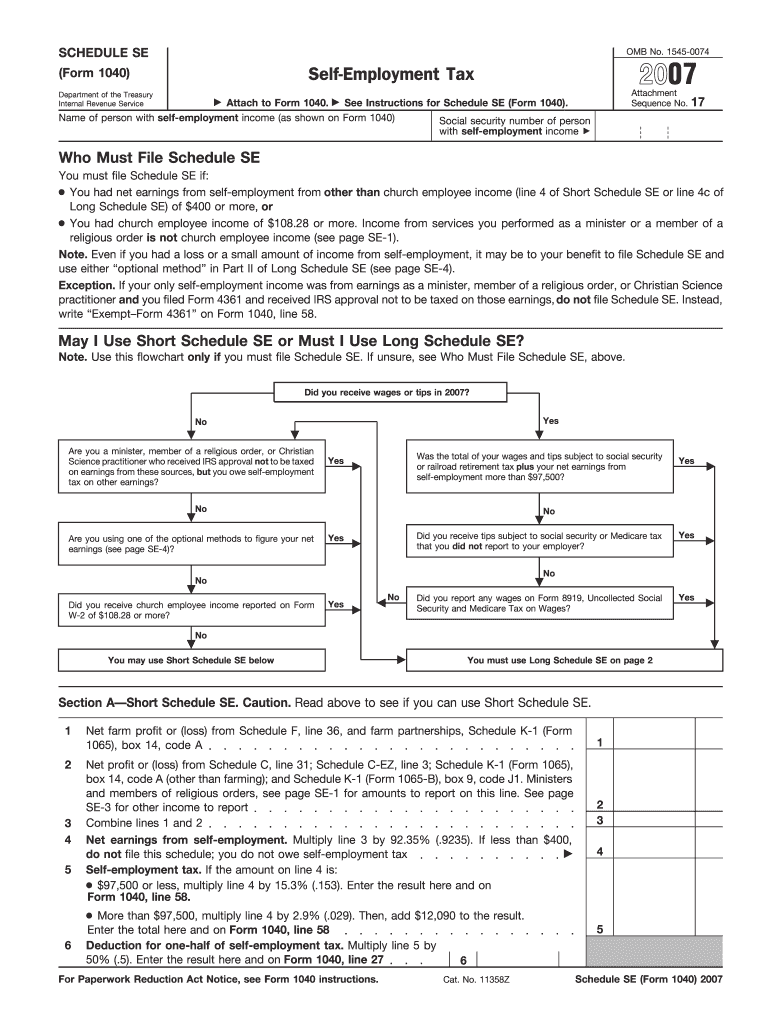

Laws dot-com legal forms guide self-employment tax Schedule S II the flowchart in this form will inform you of whether you can elect to fill out the short schedule SE or the long spiritual SE step one if you're self-employed you need to fill out the form if you make four hundred dollars or more if you're a church employee you need to fill out the form if you made one hundred eight dollars and 28 cents or more in most cases you'll have to fill out this form if you're a minister or member of a religious order however if you file form forty-three sixty-one and received IRS approval you're exempt from the SE tax refer to pages SE one through SE three in the following guide for more information on self-employed professions step 2 online one B of the short or long version enter the total amount of your taxable CR P payments if you're receiving Social Security retirement or disability benefits at the time you received your CR P payments the payments are included on Schedule F line for B or on form 1065 box 20 code y step 3 if line four on the short version is less than four hundred dollars you have an amount on line one be combined lines one a and two if the total on lines one a and two is four hundred thirty-four dollars or more file this form with your tax return and enter zero uniform 1040 line 56 or form 1040 and our line 54 if lines 1a and two is less than four hundred thirty-four dollars do not file Schedule SE unless you have an optional method for figuring out your SE tax step 4 if both lines for a and for C on the long version are less than four hundred dollars and there is an amount on line 1 B combine lines one a and two if the total amount on lines one and two is four hundred thirty-four dollars or more file this form with your tax return enter zero on form 1040 line 56 and complete lines 5a and 5b if you have Church employee income if the total of lines 1a and two is less than four hundred thirty-four dollars do not file this form unless you choose another method for calculating your SE tax Step five for specific instructions on net earning form self-employment regard pages s III through SE five in the instructional guide to watch more videos please make sure to visit laws com

People Also Ask about

What is Schedule C and SE on 1040?

How do I fill out line 14 on 1040?

What is line 14 on 1040?

What is Schedule SE line 14 on 1040?

Who should fill out Schedule SE?

What is the schedule se on the 1040 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit schedule se for 2007 from Google Drive?

How can I send schedule se for 2007 for eSignature?

Can I edit schedule se for 2007 on an iOS device?

What is schedule se for form?

Who is required to file schedule se for form?

How to fill out schedule se for form?

What is the purpose of schedule se for form?

What information must be reported on schedule se for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.