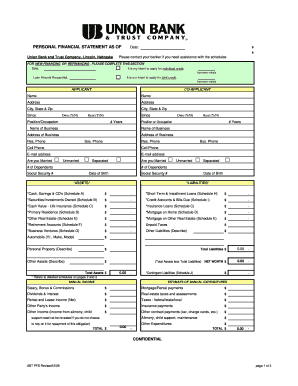

Fillable Personal Financial Statement Excel

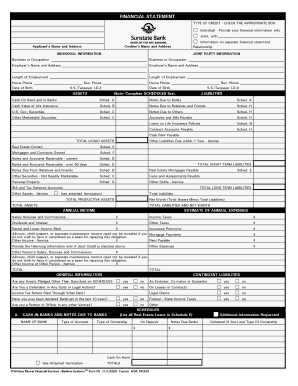

What is fillable personal financial statement excel?

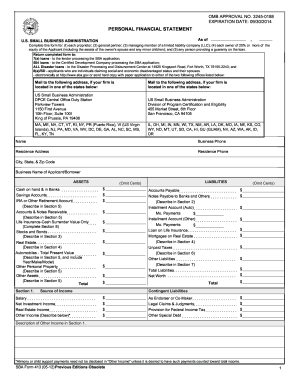

A fillable personal financial statement excel is a customizable template that allows individuals to input their financial information in an organized manner. It simplifies the process of creating a personal financial statement by providing a structured format in an excel spreadsheet. This template enables users to easily track and analyze their income, expenses, assets, and liabilities.

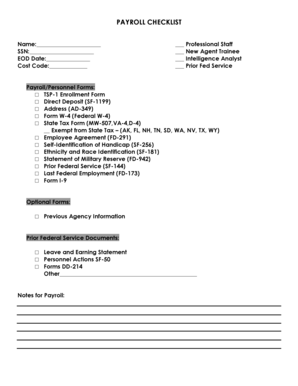

What are the types of fillable personal financial statement excel?

There are different types of fillable personal financial statement excel templates available to cater to various needs. Some common types include:

How to complete fillable personal financial statement excel

Completing a fillable personal financial statement excel is straightforward and user-friendly. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.