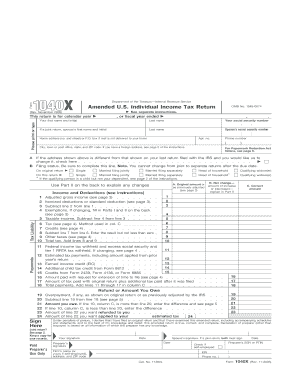

Form 1040x Instructions

What is form 1040x instructions?

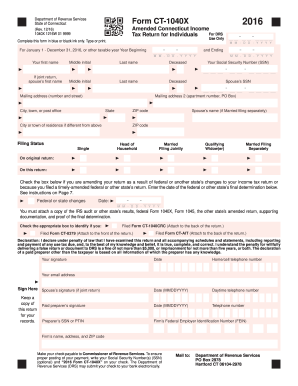

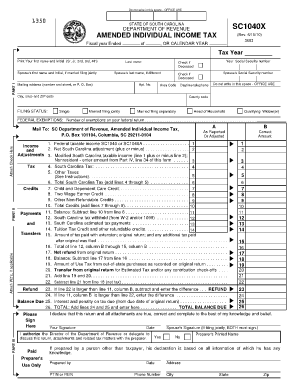

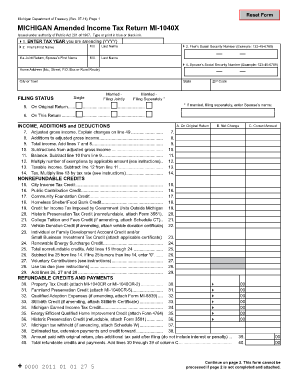

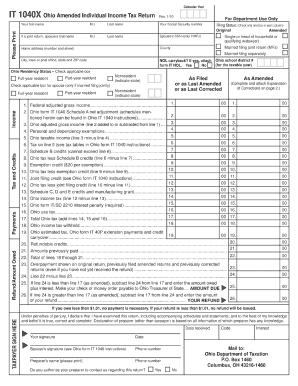

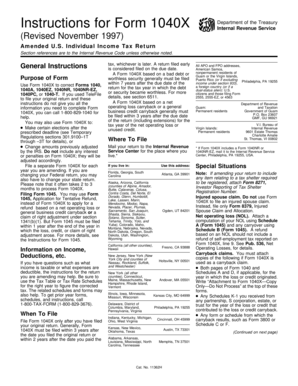

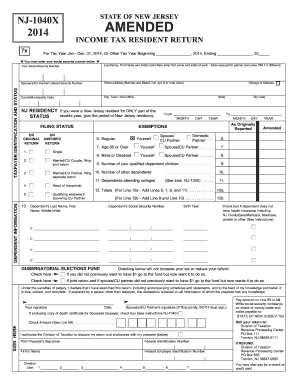

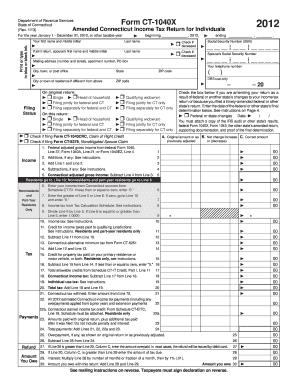

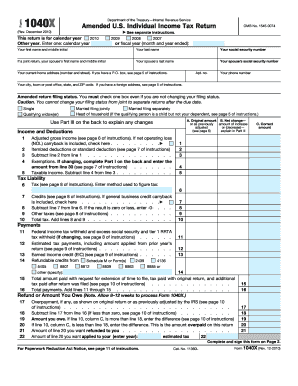

Form 1040X instructions are guidelines provided by the Internal Revenue Service (IRS) on how to amend a previously filed tax return. These instructions help taxpayers understand the necessary steps and requirements for making corrections or changes to their original return.

What are the types of form 1040x instructions?

There are several types of form 1040X instructions available, including:

General instructions: These provide an overview of the form and explain who should file it.

Specific instructions: These cover different sections of form 1040X and provide detailed information on how to fill them out correctly.

Filing status instructions: These guide taxpayers in determining the appropriate filing status to use when amending their return.

Income adjustment instructions: These explain how to report changes in income and deductions that affect the amended return.

Payment instructions: These outline the methods of payment for taxes owed or refund due.

Mailing instructions: These specify where to send the completed form 1040X.

How to complete form 1040x instructions

Completing form 1040X requires careful attention to detail. Here are the step-by-step instructions to help you complete the form accurately:

01

Gather all necessary documents, including your original tax return, supporting documentation for changes, and any additional forms required.

02

Download form 1040X from the IRS website or use a trusted online platform like pdfFiller to access a fillable version.

03

Fill in your personal information, such as name, Social Security number, and address. Make sure to use the same information as on your original tax return.

04

Indicate the tax year you are amending and the type of return you initially filed (e.g., 1040, 1040A, 1040EZ).

05

Provide an explanation for each change or correction you are making. Be clear and concise in your explanations.

06

Follow the instructions for each section and enter the correct figures in the designated spaces.

07

Double-check all the information you have entered to ensure accuracy.

08

Sign and date the completed form.

09

Make a copy of the completed form and keep it for your records.

10

Mail the form to the appropriate IRS address as specified in the form's instructions.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get all your documents done efficiently and securely.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I fill out a 1040X amended tax return?

1:15 2:11 Learn How to Fill the Form 1040X Amended U.S. Individual - YouTube YouTube Start of suggested clip End of suggested clip 1040 enter any changed amounts and the correct amount in the appropriate boxes. Complete the formMore1040 enter any changed amounts and the correct amount in the appropriate boxes. Complete the form 1040x copying line for line all. Information as it appeared on your original.

Can I fill out a 1040X myself?

More In Help Can I file an amended Form 1040-X electronically? You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR.

How do I fill out a 1040X for dummies?

1:20 2:11 Learn How to Fill the Form 1040X Amended U.S. Individual - YouTube YouTube Start of suggested clip End of suggested clip Tax return for items that you have amended you must include the original amount the changed amountMoreTax return for items that you have amended you must include the original amount the changed amount and the correct amount. Once you have completed all lines one through 31.

Can I amend my tax return by myself?

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

Do I have to fill out everything on 1040X?

What to Include With Form 1040x. Other than the forms and schedules impacted by your amendment, you generally don't have to include anything else with Form 1040-X. For example, don't include a copy of your original tax return, IRS notices, or any other documents unless you've been instructed to do so.

What forms must be attached to an amended tax return?

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. Be advised – you can't e-file an amended return. A paper form must be mailed in. You should consider filing an amended tax return if there is a change in your filing status, income, deductions or credits.