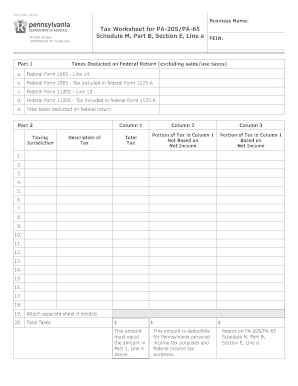

Form 1125-a

What is form 1125-a?

Form 1125-a is a document used by businesses to report cost of goods sold, as well as certain expenses related to inventory. It provides detailed information on a company's cost of goods sold, including the calculation of beginning and ending inventory, purchases, and various adjustments.

What are the types of form 1125-a?

Form 1125-a has two types, depending on the size and nature of the business. The first type is used by smaller businesses that qualify for the cash accounting method. The second type is for larger businesses, typically those with inventory exceeding $1 million, and it requires the use of the accrual accounting method.

How to complete form 1125-a

Completing form 1125-a may seem daunting, but with the right guidance, it becomes a manageable task. Here is a step-by-step guide to help you:

By using pdfFiller, you can simplify the process of completing form 1125-a. With pdfFiller's unlimited fillable templates and powerful editing tools, you can easily create, edit, and share your documents online. Say goodbye to complicated paperwork and hello to a streamlined document management experience.