Form 1065 Due Date

What is form 1065 due date?

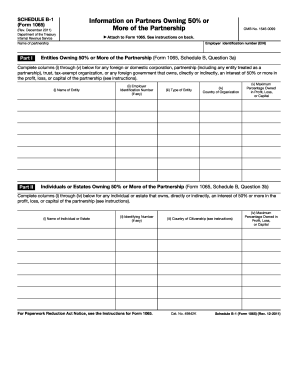

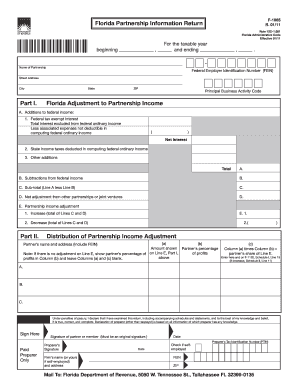

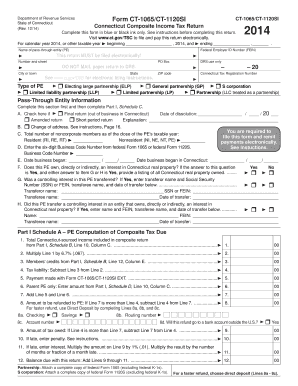

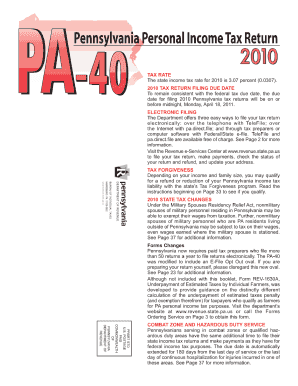

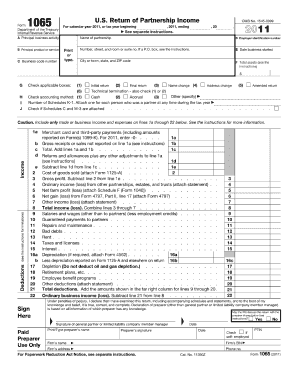

The form 1065 due date is the deadline for partnership tax returns. Partnerships are required to file Form 1065 to report their income, deductions, and credits. The due date for Form 1065 is generally on the 15th day of the third month after the end of the partnership's tax year. For example, if the tax year ends on December 31st, the due date for Form 1065 would be March 15th.

What are the types of form 1065 due date?

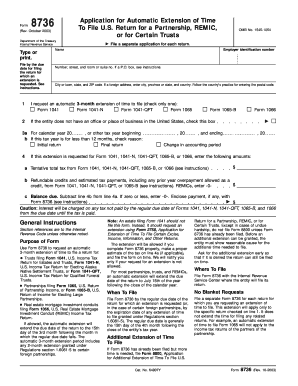

There are two types of Form 1065 due dates based on the fiscal year-end of the partnership. The regular due date is applicable to partnerships with a calendar year-end, meaning their tax year ends on December 31st. The extended due date, which provides additional time to file the return, is available for partnerships with a fiscal year-end other than December 31st. It's important to note that partnerships must file for an extension to be eligible for the extended due date.

How to complete form 1065 due date

Completing Form 1065 requires accurate and timely documentation. Follow these steps to ensure a smooth filing process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.