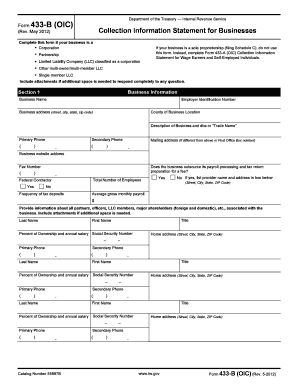

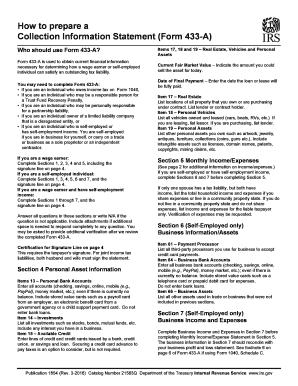

Form 433-a Oic

What is Form 433-A OIC?

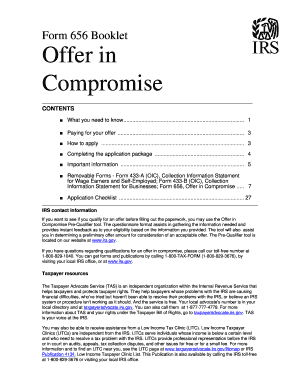

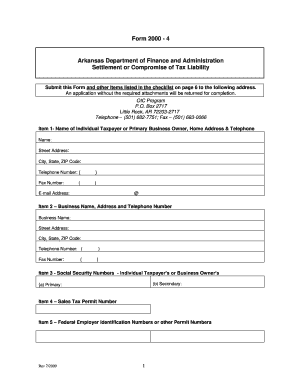

Form 433-A OIC is a financial statement used by taxpayers to apply for an Offer in Compromise (OIC) with the Internal Revenue Service (IRS). It is specifically designed for individuals or self-employed persons who are unable to pay their full tax liability due to financial hardships. By filing Form 433-A OIC, taxpayers can propose an alternative payment plan to settle their tax debt with the IRS.

What are the types of Form 433-A OIC?

There are three types of Form 433-A OIC, depending on the financial situation of the taxpayer: 1. Form 433-A (OIC) for Wage Earners and Self-Employed Individuals - This form is for individuals who receive wages and salaries, including self-employed individuals. 2. Form 433-A (OIC) (Businesses) - This form is for businesses with employees and/or unpaid payroll taxes. 3. Form 433-A (OIC) (Individuals) - This form is for individuals who do not have employees or unpaid payroll taxes.

How to complete Form 433-A OIC

Completing Form 433-A OIC requires careful attention to detail. Here is a step-by-step guide to help you:

Please note that this guide provides a general overview, and it is advisable to consult with a tax professional or seek assistance from the IRS for specific guidance regarding your unique situation. pdfFiller can help you streamline the process of completing Form 433-A OIC and other tax-related documents. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to create, edit, and share documents online, making it the only PDF editor you need to get your documents done.