AR -4 2009 free printable template

Show details

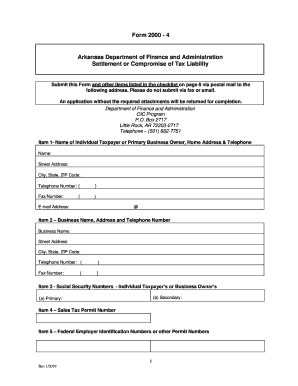

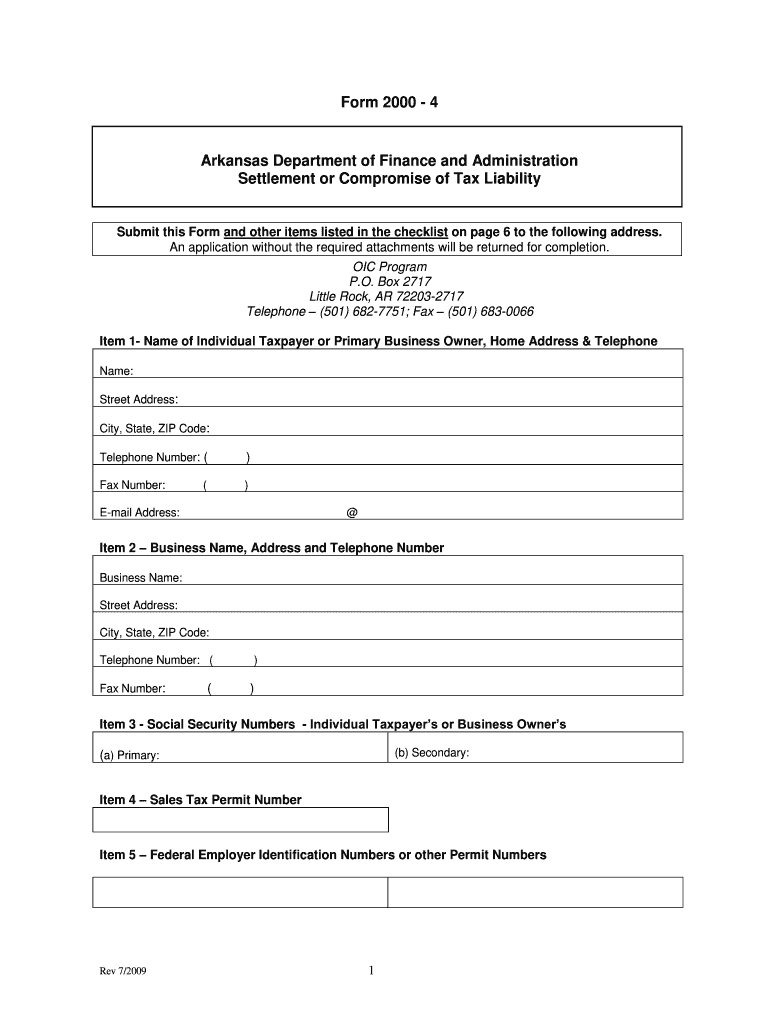

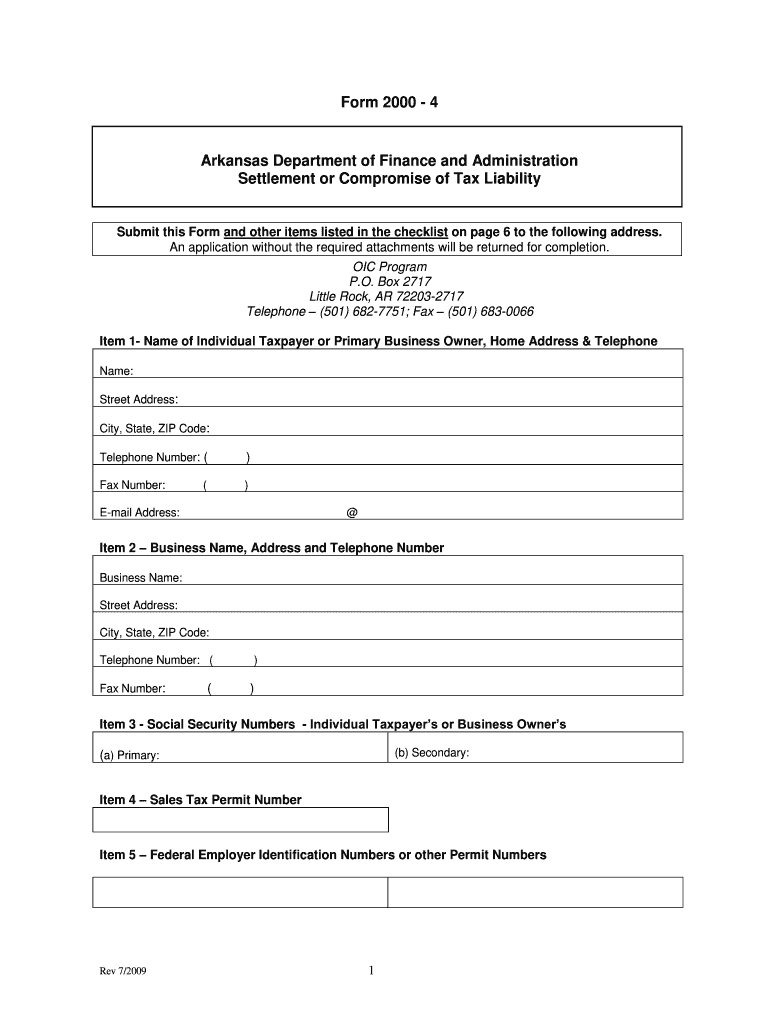

Form 2000 - 4 Arkansas Department of Finance and Administration Settlement or Compromise of Tax Liability Submit this Form and other items listed in the checklist on page 6 to the following address. If this item is not completed the offer will not be reviewed. It will be considered an incomplete offer and will be withdrawn. Include how the money that will be used to pay the offer was obtained i.e. borrowed money from bank withdrew savings etc. Th...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR -4

Edit your AR -4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR -4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR -4 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AR -4. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR 2000-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR -4

How to fill out AR -4

01

Obtain the AR-4 form from the official website or your commanding officer.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information at the top of the form, including name, rank, and unit.

04

Provide details about the incident or situation that necessitates the use of AR-4.

05

Refer to the specific sections of the form and fill them out as required.

06

Review your entries for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form to your immediate supervisor or designated authority.

Who needs AR -4?

01

Any military personnel involved in an incident or seeking to document a specific situation.

02

Supervisors and command staff who need to assess or review incidents within their unit.

03

Administrative personnel responsible for maintaining records of incidents.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up payroll in Arkansas?

Running Payroll in Arkansas—Step-by-Step Instructions Step 1: Set up your business as an employer. Step 2: Register with the State of Arkansas. Set up your payroll process. Step 4: Collect employee payroll forms. Step 5: Collect, review, and approve time sheets. Step 6: Calculate payroll and pay employees.

What is the Arkansas partnership nonresident withholding tax rate?

Arkansas Code Annotated 26-51-919(b)(1)(A) requires a pass-through entity to withhold income tax at the rate of 7% on each nonresident member's share of distributed Arkansas income.

What percentage of taxes are withheld from non residents?

Withholding. If a nonresident receives US source income, a mandatory withholding of 30% on most types of income will apply.

How to apply for an Arkansas withholding account?

You set up your account by registering your business with the DFA either online or on paper. To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form.

What is the local withholding tax in Arkansas?

Arkansas (AR) State Payroll Taxes The 2022 tax rates range from 2% on the low end to 5.5% on the high end. Employees who make more than $79,300 will hit the highest tax bracket. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

What is the partnership tax rate in Arkansas?

Arkansas Business Taxes LLCs have to file a Partnership Tax Return with the Arkansas Department of Finance and Administration. Members must file the appropriate individual income tax form and pay income taxes from 2.4% to 7%. Corporations pay a tax rate of 1% to 6.5% on net taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AR -4 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AR -4, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit AR -4 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing AR -4, you can start right away.

How do I edit AR -4 on an iOS device?

Create, edit, and share AR -4 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is AR -4?

AR -4 is a specific form used for reporting certain financial or operational information, typically related to state or federal compliance.

Who is required to file AR -4?

Entities such as businesses, organizations, or individuals that meet certain criteria set by regulations are required to file AR -4.

How to fill out AR -4?

AR -4 should be filled out by providing accurate information as requested in the form, ensuring to follow any accompanying instructions and guidelines.

What is the purpose of AR -4?

The purpose of AR -4 is to collect essential data for regulatory compliance, monitoring, or assessment purposes.

What information must be reported on AR -4?

Information such as financial data, organizational details, and specific operational metrics as required by the filing guidelines must be reported on AR -4.

Fill out your AR -4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR -4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.