AR -4 2012 free printable template

Show details

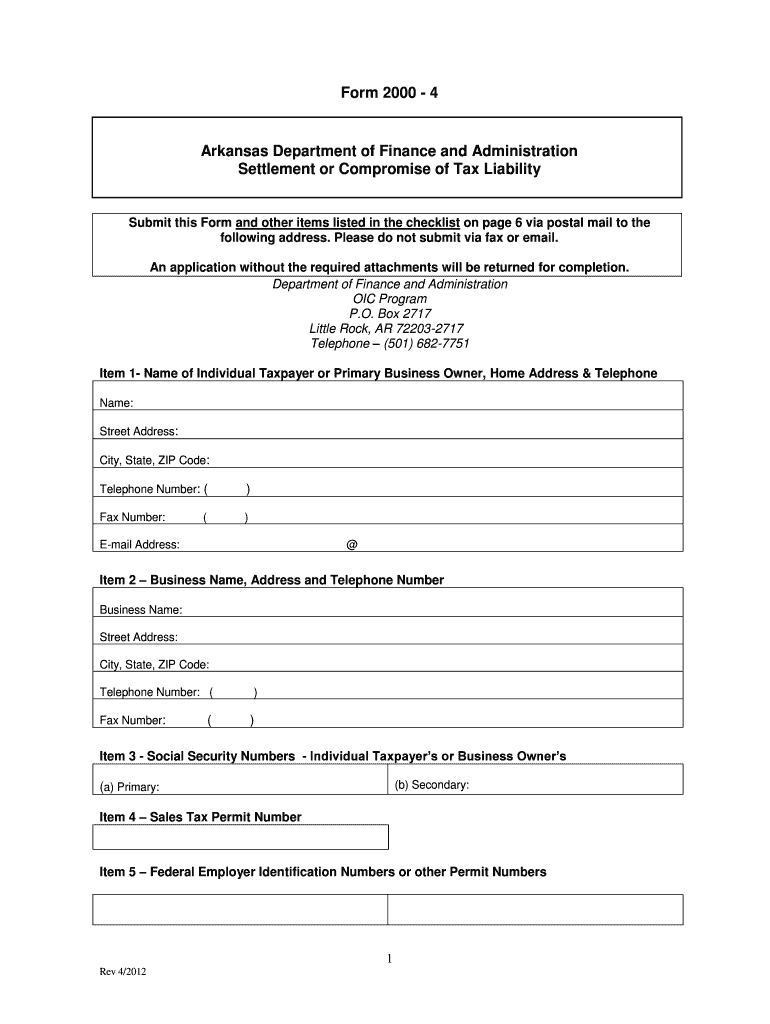

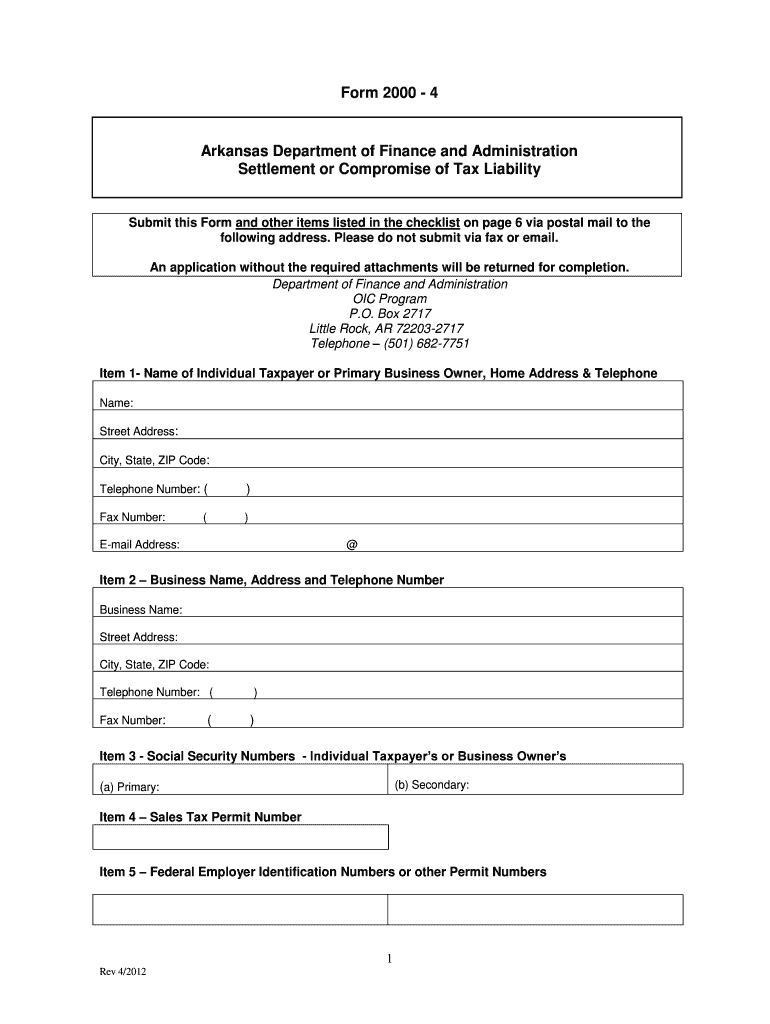

Form 2000 - 4 Arkansas Department of Finance and Administration Settlement or Compromise of Tax Liability Submit this Form and other items listed in the checklist on page 6 via postal mail to the following address. Failure to include ALL requested documents will cause your offer to be withdrawn from review. 1. Completed Offer in Compromise Form 2000-4. If the offer is for a business an officer must sign and date the form. If someone other than the taxpayer prepared the 2000-4 form please...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR -4

Edit your AR -4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR -4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR -4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AR -4. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR 2000-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR -4

How to fill out AR -4

01

Gather all required information and documents necessary for the AR-4 form.

02

Carefully read the guidelines provided with the form to understand its requirements.

03

Fill in personal information at the top of the form, ensuring accuracy.

04

Complete each section of the form methodically, following prompts and instructions.

05

Double-check all entries for errors or omissions.

06

Sign and date the form in the appropriate section.

07

Submit the completed form to the specified office or through the required submission method.

Who needs AR -4?

01

Individuals seeking to apply for benefits or services related to the AR-4 program.

02

Businesses or organizations that require the AR-4 form for compliance purposes.

03

Individuals undergoing a process that specifically mandates the completion of an AR-4.

Fill

form

: Try Risk Free

People Also Ask about

Can taxes owed be paid in installments?

Your specific tax situation will determine which payment options are available to you. Payment options include full payment, short-term payment plan (paying in 180 days or less) or a long-term payment plan (installment agreement) (paying monthly).

Who must file an Arkansas state tax return?

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

What is the statute of limitations on personal property taxes in Arkansas?

(a) (1) Except as otherwise provided in this chapter, no assessment of any tax levied under the state tax law shall be made after the expiration of three (3) years from the date the return was required to be filed or the date the return was filed, whichever period expires later.

Can you make a payment plan on sales tax in Arkansas?

The Arkansas Department of Finance and Administration (DFA) may be willing to let you pay off your back taxes in monthly payments. To qualify, you typically need to show the DFA that you cannot pay your tax liability in full but you can afford to make monthly payments.

How long can Arkansas collect back taxes?

The state of Arkansas has a 10-year statute of limitations on back taxes. This means that the state can pursue collection activities including property liens for up to 10 years after the taxes have been assessed.

What is the statute of limitations on a tax lien in Arkansas?

Statute of Limitations on Arkansas Back Taxes The state of Arkansas has a 10-year statute of limitations on back taxes. This means that the state can pursue collection activities including property liens for up to 10 years after the taxes have been assessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AR -4 to be eSigned by others?

Once your AR -4 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit AR -4 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing AR -4.

Can I edit AR -4 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share AR -4 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is AR -4?

AR -4 is a tax form used by certain entities to report specific types of tax-related information to the relevant tax authorities.

Who is required to file AR -4?

Entities that meet certain criteria, such as having specific types of income or operating in particular sectors, are required to file AR -4.

How to fill out AR -4?

To fill out AR -4, gather all necessary financial information, complete the form according to the provided instructions, and ensure that all required signatures are affixed before submission.

What is the purpose of AR -4?

The purpose of AR -4 is to provide tax authorities with detailed information that aids in tax compliance and the assessment of tax liabilities.

What information must be reported on AR -4?

AR -4 typically requires reporting of income, expenses, deductions, and any other relevant financial data that the tax authorities need to accurately assess the tax situation of the filing entity.

Fill out your AR -4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR -4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.