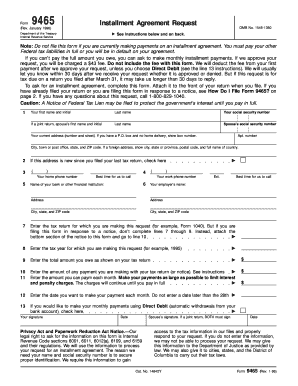

Form 9465 - Page 2

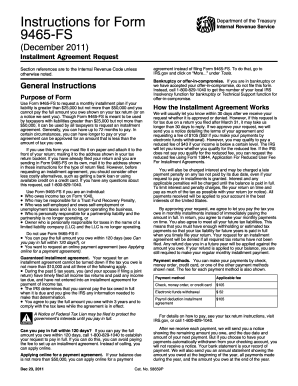

What is Form 9465?

Form 9465 is a document used by taxpayers who are unable to pay their tax liability in full. It allows individuals to request a monthly installment plan to pay off their tax debt over time. By completing Form 9465, taxpayers can avoid facing penalties for failure to pay their taxes on time.

What are the types of Form 9465?

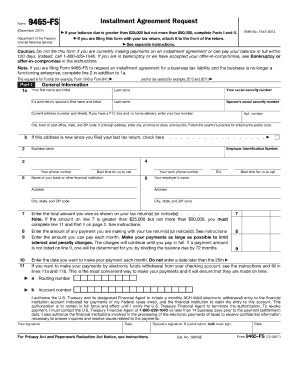

There are two types of Form 9465 that taxpayers can use: 1. Regular Installment Agreement: This type of installment agreement is for taxpayers who owe $50,000 or less in combined tax, penalties, and interest. 2. Streamlined Installment Agreement: This type of installment agreement is available for taxpayers who owe $50,000 or less in combined tax, penalties, and interest, and can pay off the debt within 72 months.

How to complete Form 9465

Completing Form 9465 is a straightforward process. Here are the steps to follow: 1. Gather the necessary information: You will need your personal information, including your Social Security number and contact details. You also need to know the amount you owe. 2. Identify the type of installment agreement: Determine whether you are eligible for a regular or streamlined installment agreement based on the amount you owe. 3. Fill in Form 9465: Enter your personal information, tax liability amount, and choose the type of installment agreement you are applying for. 4. Attach supporting documents: If necessary, include any additional documents requested by the IRS to support your installment agreement request. 5. Review and submit: Double-check all the information provided and make sure it is accurate. Sign and submit the form to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Start using pdfFiller today to simplify your document processes.