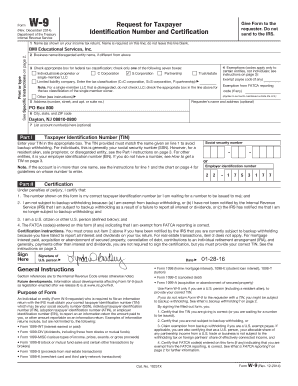

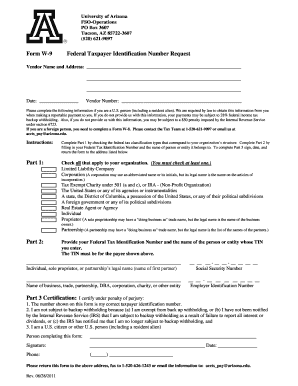

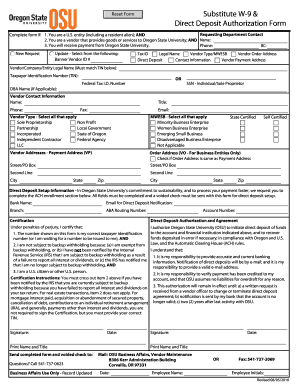

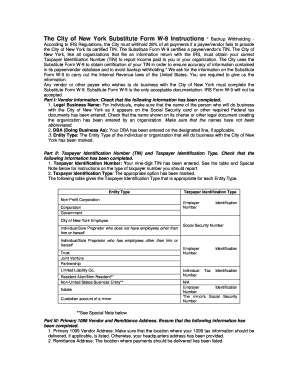

Form W-9

What is Form W-9?

Form W-9 is an IRS tax form used by businesses to collect the taxpayer identification number (TIN) of individuals who are U.S. citizens, resident aliens, or companies operating in the United States. It is commonly used for reporting income and filing tax returns.

What are the types of Form W-9?

Form W-9 has only one type, which is the Request for Taxpayer Identification Number and Certification. This form is used by businesses and payers to gather essential information from the payee in order to accurately report payments and income to the IRS.

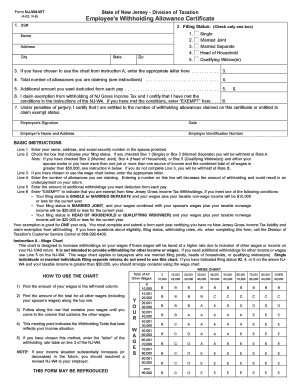

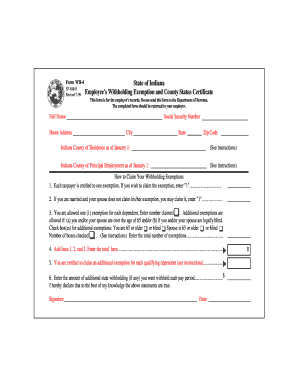

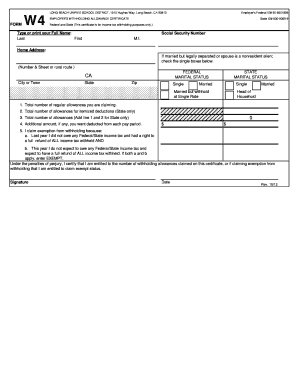

How to complete Form W-9

Completing Form W-9 is a straightforward process. Here are the steps to fill it out correctly:

To make the process even easier, you can use the online platform pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.