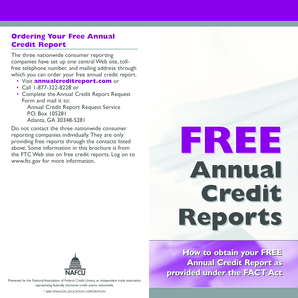

Free Annual Credit Report

What is free annual credit report?

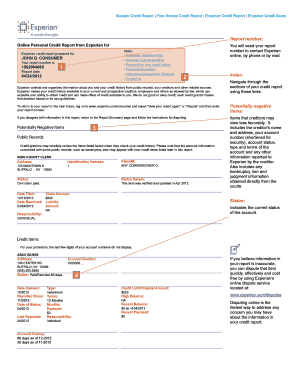

A free annual credit report is a comprehensive document that provides an overview of an individual's credit history and financial standing. It includes information on credit accounts, balances, payment history, and any negative or positive events that may impact a person's credit score. The report is essential for anyone looking to understand their creditworthiness and detect any errors or fraudulent activities on their credit file.

What are the types of free annual credit report?

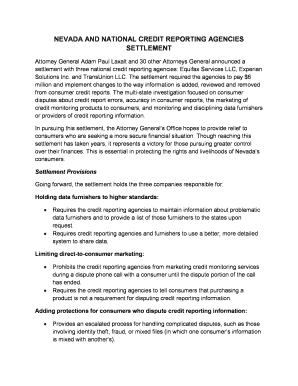

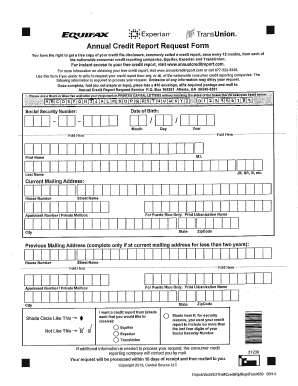

There are three major types of free annual credit reports available to consumers: 1. Equifax Credit Report: This report includes information obtained from the Equifax credit bureau and provides a detailed overview of an individual's credit history and financial activities as reported by creditors and lenders. 2. Experian Credit Report: The Experian credit report offers similar information on an individual's credit history but draws data from the Experian credit bureau. It provides a comprehensive view of an individual's creditworthiness based on their financial activities reported by various creditors. 3. TransUnion Credit Report: The TransUnion credit report is another type of free annual credit report that gathers data from the TransUnion credit bureau. It provides a comprehensive overview of an individual's credit history and financial activities, allowing them to understand their creditworthiness and identify any potential issues or inaccuracies in their credit file.

How to complete free annual credit report

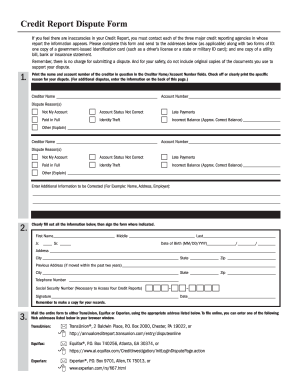

Completing a free annual credit report is a relatively straightforward process. Here are the steps to follow: 1. Visit the official website of any of the major credit bureaus, such as Equifax, Experian, or TransUnion. 2. Look for the section that offers free annual credit reports and click on the appropriate link. 3. Provide the necessary personal information, including your name, date of birth, social security number, and current address. 4. Verify your identity through the provided verification process, which may involve answering security questions or providing additional identification documents. 5. Review your credit report carefully, ensuring that all information is accurate and up to date. If you notice any errors or discrepancies, make sure to report them to the respective credit bureau. 6. Take advantage of any additional services or tools offered by the credit bureau to monitor your credit and protect against identity theft. By following these steps, you can easily complete your free annual credit report and gain valuable insights into your financial standing and creditworthiness.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.