General Partnership Agreement - Page 2

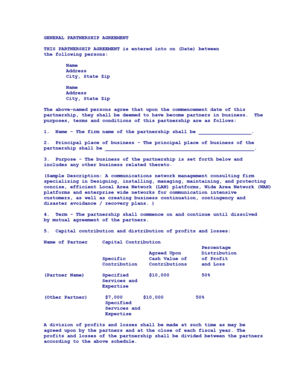

What is a General Partnership Agreement?

A General Partnership Agreement is a legal document that outlines the framework of a business partnership between two or more individuals. It includes details such as the roles and responsibilities of each partner, profit-sharing arrangements, decision-making processes, and dispute resolution procedures.

What are the types of General Partnership Agreement?

There are two main types of General Partnership Agreements: written and oral. Written agreements are preferred as they provide clear documentation of the partnership terms and can help avoid misunderstandings in the future.

How to complete a General Partnership Agreement

Completing a General Partnership Agreement can be a straightforward process with the right tools and guidance. Here are some steps to help you create a comprehensive agreement:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.