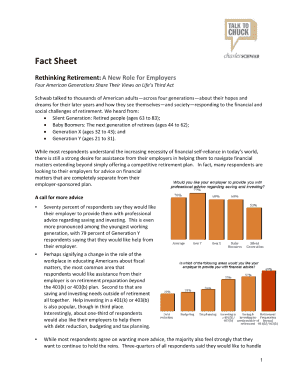

Retirement Savings Calculators

What is Retirement Savings Calculators?

Retirement Savings Calculators are online tools that help individuals estimate how much money they should save for retirement. By inputting information such as current age, desired retirement age, income level, expected inflation rate, and investment returns, users can get a rough idea of how much they need to save each month to achieve their retirement goals. These calculators take into account various factors such as life expectancy, retirement lifestyle, and Social Security benefits to provide a personalized savings plan.

What are the types of Retirement Savings Calculators?

There are several types of Retirement Savings Calculators available, each catering to different needs and preferences. Some common types include: 1. Basic Retirement Calculator: This calculator provides a general estimate of the amount needed to save for retirement based on basic inputs like age, income, and desired retirement age. 2. Advanced Retirement Calculator: This calculator offers more comprehensive features, allowing users to consider additional factors such as anticipated healthcare expenses, expected Social Security benefits, and other sources of retirement income. 3. Retirement Income Calculator: This calculator focuses on estimating the income that can be generated during retirement based on current savings, investments, and expected returns. 4. Retirement Spending Calculator: This calculator helps users determine an appropriate budget for retirement by considering factors such as anticipated expenses, inflation rates, and lifestyle choices.

How to complete Retirement Savings Calculators

Completing Retirement Savings Calculators is a straightforward process. Follow these steps to get started:

By using Retirement Savings Calculators, individuals can make informed decisions about their retirement savings strategy and take the necessary steps to ensure a financially secure retirement.