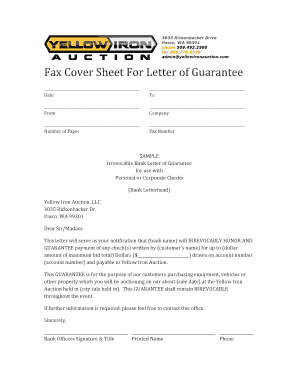

Sample Corporate Guarantee Letter

What is a sample corporate guarantee letter?

A sample corporate guarantee letter is a legally binding document that a company issues as a guarantee for another company or individual's financial obligations. It assures the recipient that the guaranteeing company will fulfill any financial commitments if the primary debtor fails to do so. This letter serves as a form of insurance against potential financial losses.

What are the types of sample corporate guarantee letter?

There are several types of sample corporate guarantee letters, including:

Performance Guarantee: This type of letter guarantees that the company will fulfill its obligations regarding performance, quality, or completion of a project.

Payment Guarantee: This letter ensures that a company will make payments according to the agreed terms and conditions.

Financial Guarantee: This type of guarantee letter assures the recipient that the company will meet its financial obligations, such as repaying a loan or covering any potential losses.

Bid Bond Guarantee: This letter is commonly used in the construction industry to guarantee that a bidder will enter into a contract and provide the necessary performance or payment bonds if awarded the project.

How to complete a sample corporate guarantee letter?

To complete a sample corporate guarantee letter, follow these steps:

01

Start by addressing the letter to the recipient (individual or company) who will receive the guarantee.

02

Clearly state the purpose of the guarantee, including the type of guarantee and any specific details or terms involved.

03

Provide a detailed explanation of the company's commitment and their willingness to fulfill any financial obligations if the primary debtor fails to do so.

04

Include relevant contact information, such as the guaranteeing company's name, address, phone number, and email.

05

Review the letter for accuracy and clarity, ensuring all necessary information is included.

06

Sign the letter and have it notarized if required by law or requested by the recipient.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out sample corporate guarantee letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of a guarantor?

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead. If your guarantor doesn't pay, your landlord can take them to court.

How do you write a guarantor letter to a company?

In this regard, I guarantee that the said person is having good moral character. I also ensure that he would not be doing any illegal activities inside or outside the company's premises. Also, _______________________ (mention other guarantee). You may consider this letter as an employment guarantee of the said person.

What is a corporate guarantee?

A guarantee in which a corporation agrees to be held responsible for completing the duties and obligations of a Sponsor, in the event that the Sponsor fails to fulfill the terms of the contract.

What are the three 3 types of guarantees?

Retrospective guarantee – It is a guarantee issued when the debt is already outstanding. Prospective guarantee – Given in regard to a future debt. Specific guarantee – Also known as a simple guarantee, it's a type that is used when dealing with a single transaction, and therefore a single debt.

How do you write a guarantor letter to a company?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

How do you write a good guarantor letter?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

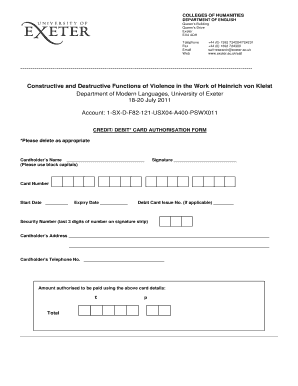

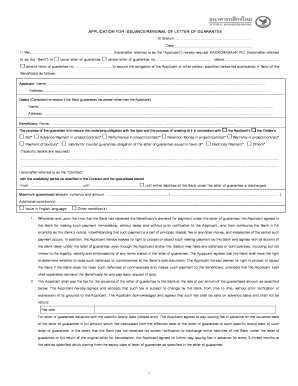

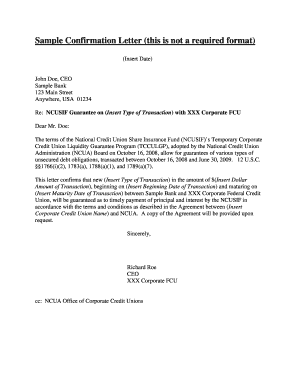

Related templates