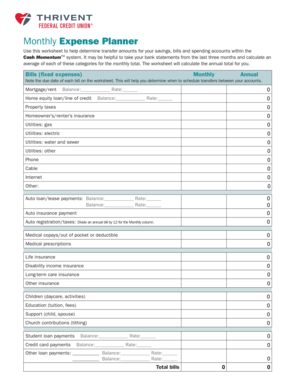

What is household budget planner?

A household budget planner is a tool that helps individuals or families track and manage their income and expenses. It allows users to plan and allocate their money effectively, ensuring that they are able to meet their financial goals and obligations. With a household budget planner, users can have a clear view of their financial situation and make informed decisions about their spending and saving habits.

What are the types of household budget planner?

There are several types of household budget planners available to cater to different needs and preferences. Some of the common types include:

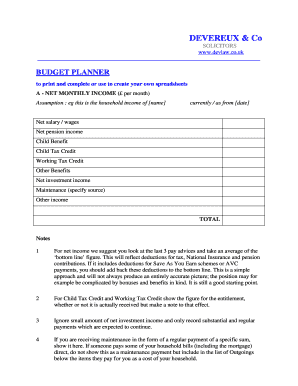

Spreadsheets: Many people prefer using spreadsheets like Excel to create and manage their household budgets. They provide a customizable and flexible platform to track income, expenses, and savings.

Mobile Apps: In the digital age, there are various mobile apps available that provide budgeting features. These apps often come with additional features like expense tracking, bill reminders, and goal setting.

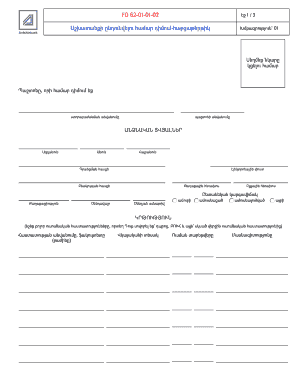

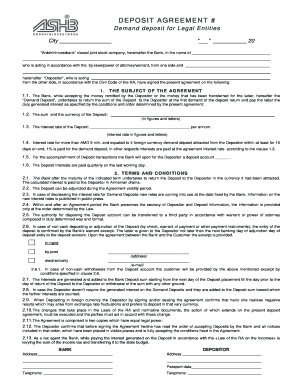

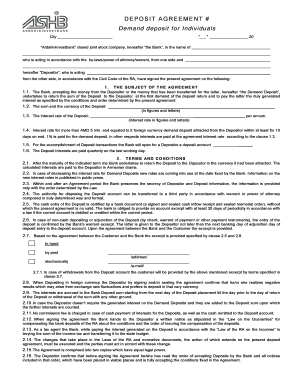

Online Tools: Online tools like pdfFiller empower users to create, edit, and share their budget planners online. They offer unlimited fillable templates and powerful editing tools, making it convenient to create and customize budget plans.

Paper Planners: Traditionalists may prefer using paper planners, where they can manually write down their income and expenses. These planners are portable and accessible even without an internet connection.

How to complete household budget planner

Completing a household budget planner is a straightforward process that involves the following steps:

01

Gather financial information: Collect all the necessary financial information, including income sources, bills, expenses, and existing debts.

02

Set financial goals: Determine your short-term and long-term financial goals. This could include saving for a down payment, paying off debts, or building an emergency fund.

03

Determine income and expenses: Calculate your monthly income and list all your expenses. Categorize your expenses into fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

04

Allocate funds: Assign a specific amount of money to each expense category based on your income and priorities. Ensure that your total expenses do not exceed your income.

05

Track and adjust: Regularly update your budget planner by recording your income and expenses. Analyze your spending patterns and make necessary adjustments to stay on track with your financial goals.

pdfFiller, an online tool, empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.