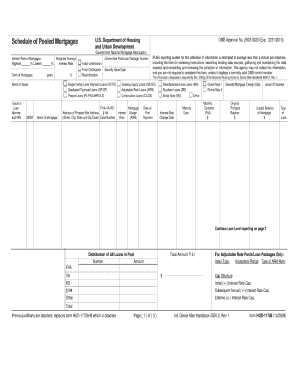

Hud-1 Closing Disclosure - Page 2

What is hud-1 closing disclosure?

The hud-1 closing disclosure is an important document that outlines the financial details of a real estate transaction. It provides a breakdown of all the costs involved in buying or selling a property, including loan fees, closing costs, and any credits or adjustments. This document is required by law to be provided to the buyer and seller at least three business days before the closing date to ensure transparency and accuracy.

What are the types of hud-1 closing disclosure?

There are two main types of hud-1 closing disclosures: the buyer's closing disclosure and the seller's closing disclosure. The buyer's closing disclosure is prepared by the lender and typically includes information about the loan, such as the interest rate, loan amount, and any prepayment penalties. The seller's closing disclosure, on the other hand, focuses on the seller's side of the transaction and provides details about their proceeds from the sale and any fees or credits associated with the transaction.

How to complete hud-1 closing disclosure

Completing a hud-1 closing disclosure requires careful attention to detail. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.