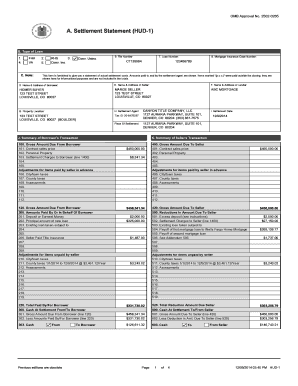

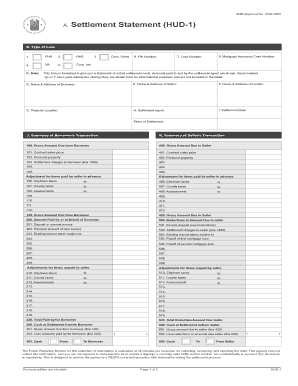

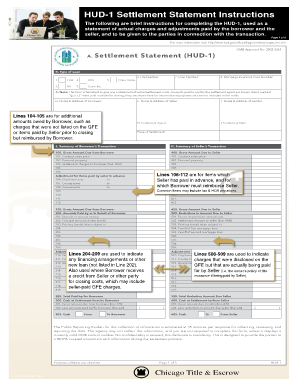

Hud-1 Settlement Statement

What is Hud-1 Settlement Statement?

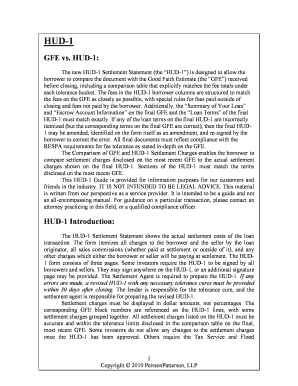

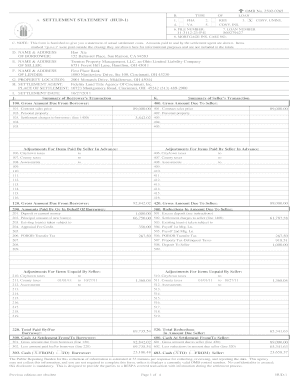

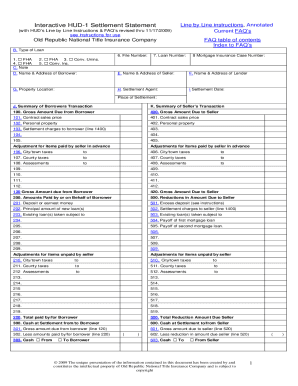

The Hud-1 Settlement Statement is a financial document that provides a detailed breakdown of all the costs involved in a real estate transaction. It is used in the United States during the closing process of buying or refinancing a property. This statement outlines all the fees, charges, and payments that both the buyer and seller are responsible for. It ensures transparency and accountability in the real estate transaction.

What are the types of Hud-1 Settlement Statement?

There are two main types of Hud-1 Settlement Statements: the HUD-1A and the HUD-1. The HUD-1A is used for refinancing transactions, while the HUD-1 is used for purchase transactions. Both types serve the same purpose of itemizing all the costs and expenses involved in the real estate transaction. The main difference lies in the format and layout of the document.

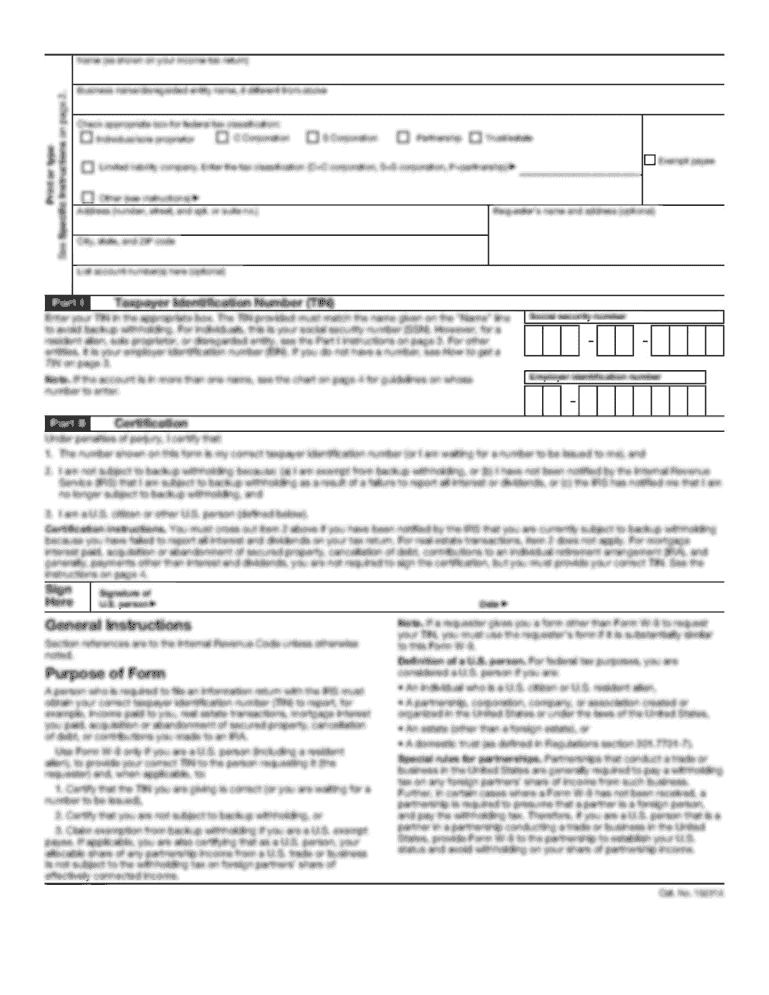

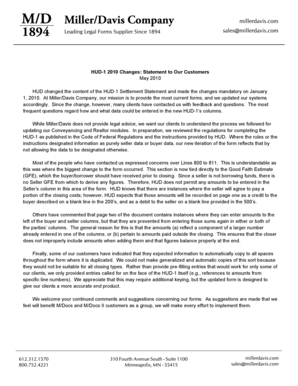

How to complete Hud-1 Settlement Statement

Completing a Hud-1 Settlement Statement requires careful attention to detail and accurate data. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.