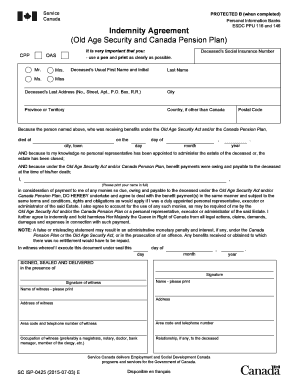

Indemnity Agreement - Page 4

What is Indemnity Agreement?

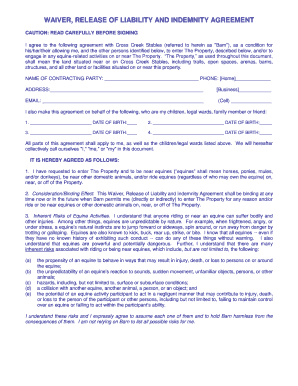

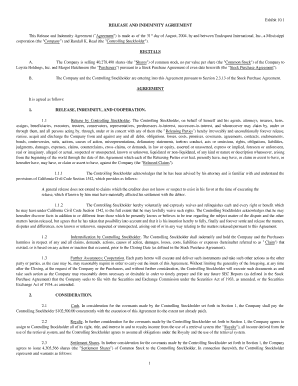

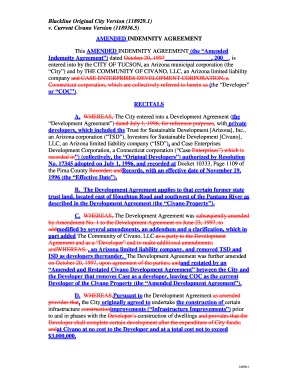

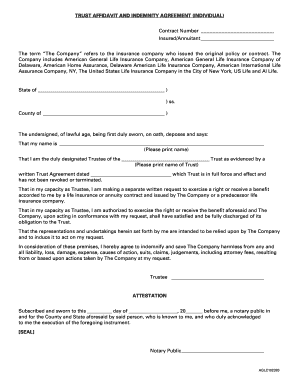

An Indemnity Agreement is a legal contract between two parties that outlines the obligations and responsibilities of each party in case of potential losses, damages, or claims. It is designed to protect one party (the indemnitee) from financial losses that may arise from certain actions or situations caused by the other party (the indemnitor). This agreement allows the indemnitee to seek reimbursement or compensation for any losses incurred due to the actions of the indemnitor.

What are the types of Indemnity Agreement?

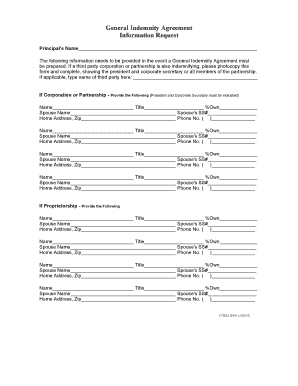

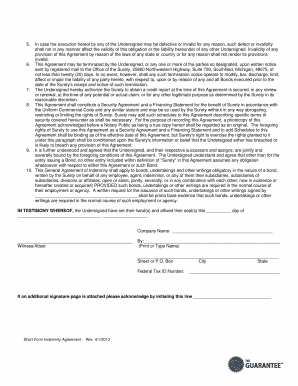

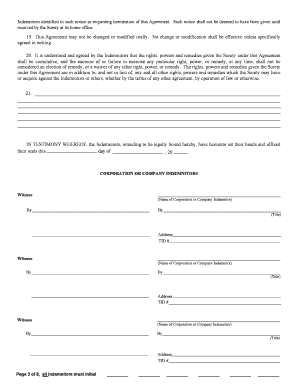

There are different types of Indemnity Agreements that cater to various situations and circumstances. Some common types include: 1. General Indemnity Agreement: This type of agreement provides broad indemnification for all potential claims and losses. 2. Limited Indemnity Agreement: This type of agreement limits the indemnitor's obligations to specific claims or losses. 3. Hold Harmless Agreement: This agreement puts the responsibility on one party to indemnify and hold the other party harmless from any claims or damages. 4. Comparative Indemnity Agreement: This agreement divides the liability between the parties based on their respective degrees of fault.

How to complete Indemnity Agreement

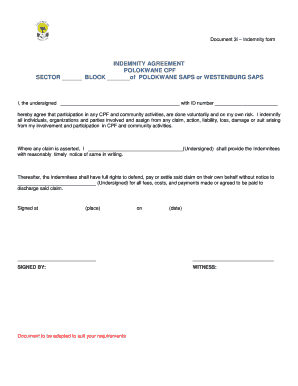

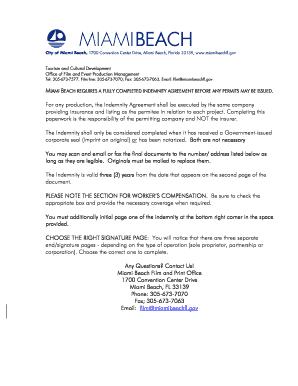

Completing an Indemnity Agreement is a straightforward process. Here are the steps to follow: 1. Introduction: Clearly state the parties involved in the agreement, their roles, and positions. 2. Scope of Indemnification: Define the specific actions, situations, or events for which the indemnitor will be responsible. 3. Indemnity Clause: Clearly outline the indemnitor's obligation to indemnify and hold the indemnitee harmless from any claims or losses arising from the defined situations. 4. Limitations and Exceptions: Specify any limitations or exceptions to the indemnitor's obligations, if applicable. 5. Governing Law and Jurisdiction: Include a clause that determines the applicable laws and jurisdiction in case of disputes. 6. Signatures: Make sure both parties sign the agreement to indicate their consent and acceptance of the terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.