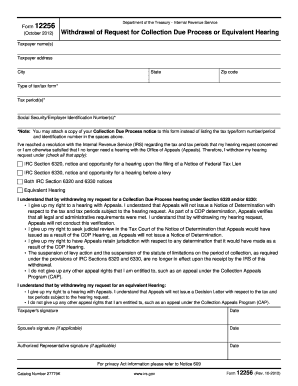

What is 12256 Form?

The 12256 Form is a document used for XYZ purpose. It is an important form that allows individuals to...

What are the types of 12256 Form?

There are different types of 12256 Forms available, each specifically designed for different situations. The most common types include:

Type Purpose 1

Type Purpose 2

Type Purpose 3

How to complete 12256 Form

Completing the 12256 Form is a straightforward process. Follow the steps below to ensure a smooth completion:

01

Gather all the required information and supporting documents.

02

Read the instructions carefully and understand the purpose of the form.

03

Fill in the necessary details in the designated fields.

04

Double-check all the information provided for accuracy.

05

Sign and date the form as required.

06

Save a copy of the completed form for your records.

07

Submit the form to the appropriate recipient.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 12256 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I request a collection from due process hearing?

Call the phone number on the CDP notice or 1-800-829-1040 if you are not sure about the correct address or if you want to fax your hearing request.

What is an IRS collection due process hearing?

A. A CDP hearing is an opportunity to discuss alternatives to enforced collection and permits you to dispute the amount you owe if you have not had a prior opportunity to do so. You do not need to wait for the final notice and it is in your best interest to respond to Notice CP504.

How do I request an IRS hearing?

your local IRS office, or by calling toll-free 1-800-TAX-FORM (829-3676). What Are Examples of Reasons for Requesting a Hearing? You will have to explain your reason for requesting a hearing when you make your request.

What is form 12256?

Form 12256,Withdrawal of Request for Collection Due Process or Equivalent Hearing.

How do I request a Collection Appeals Program hearing?

1. If you disagree with the decision regarding your installment agreement, you should appeal by completing a Form 9423, Collection Appeal Request. 2. You should provide it to the office or revenue officer who took the action regarding your installment agreement, within 30 calendar days.

How do I request a collection due process hearing?

Call the phone number on the CDP notice or 1-800-829-1040 if you are not sure about the correct address or if you want to fax your hearing request.

Related templates