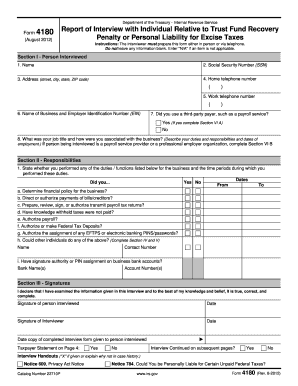

4180 Form

What is 4180 Form?

The 4180 Form is a legal document that is commonly used for employment purposes. It is also known as the Employee's Withholding Allowance Certificate. This form is used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. The 4180 Form is submitted by the employee to their employer, and it provides important information such as the employee's filing status, number of dependents, and any additional withholding allowances.

What are the types of 4180 Form?

There are two main types of 4180 Forms. The first type is the Federal 4180 Form, which is used to calculate federal income tax withholding. This form is applicable to employees in all states. The second type is the State 4180 Form, which is used to calculate state income tax withholding. This form varies depending on the state in which the employee works. It is important for employees to fill out both forms accurately to ensure the correct amount of taxes are withheld from their wages.

How to complete 4180 Form

Completing the 4180 Form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.