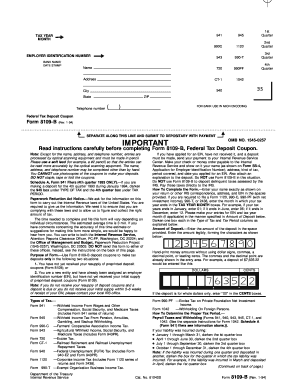

8109-B Form

What is 8109-B Form?

The 8109-B Form is a document used for reporting Federal Tax Deposits (FTDs) made by employers to the Internal Revenue Service (IRS). It serves as a record of the taxes withheld from employees' paychecks and must be filed according to the IRS guidelines.

What are the types of 8109-B Form?

There are two main types of 8109-B Forms: the 8109-B Coupon and the 8109-B FTD Coupon. The 8109-B Coupon is used for manual tax deposits, while the 8109-B FTD Coupon is used for electronic tax deposits.

8109-B Coupon

8109-B FTD Coupon

How to complete 8109-B Form

To successfully complete the 8109-B Form, follow these steps:

01

Fill out your business information accurately.

02

Enter the tax deposit amount correctly based on the IRS guidelines.

03

Attach the appropriate payment method.

04

Double-check all information for accuracy before submitting.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 8109-B Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a 1088 form for taxes?

The 1088 Tax Form is used by businesses who have received payments from other companies in what's called barter transactions. This includes any type or service that was exchanged for goods or services, such as repairs on equipment given in exchange for landscaping work.

What is a federal tax deposit coupon form 8109?

Form 8109 is also known as a federal tax deposit coupon from the Internal Revenue Service (IRS). The main purpose of Form 8109 was to keep track of tax payments made to the IRS before 2011. These tax payments were payroll taxes from employee wages, corporate income taxes, and other taxes required of businesses.

What is a 1089 form in taxes?

Every tax payment made towards employer payroll taxes, income taxes within an organization, or any other type of tax imposed is tracked through completion of the form which represents how much was paid towards what is owed by the business, which can be used in filing at the end of the fiscal year.

What is federal tax deposit coupon book?

The federal tax deposit coupon is also known as Form 8109. It is a form from the IRS. The federal tax deposit coupon is used by companies that meet the small business exception. This form used to be submitted along with federal payroll taxes.

What is a cp575 letter?

A CP 575 EIN Confirmation Letter is a document issued by the Internal Revenue Service (IRS) to confirm the unique Employer Identification Number (EIN) they have issued to a new business.

What is form 8949 Type?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

Related templates