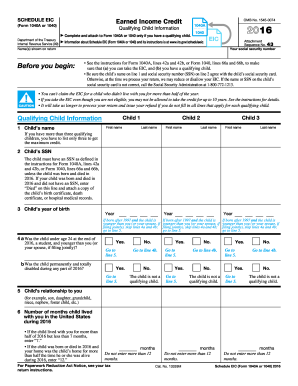

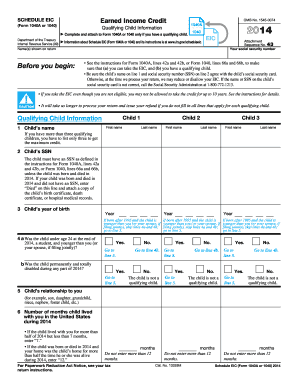

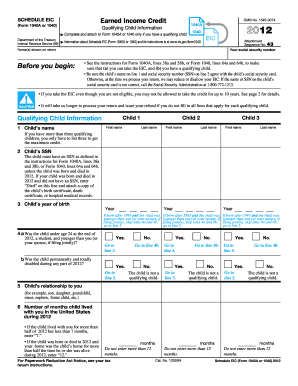

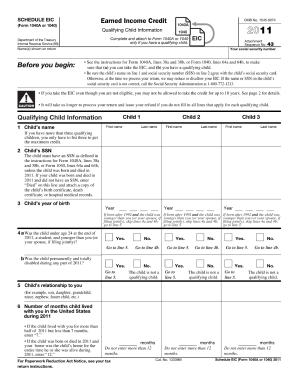

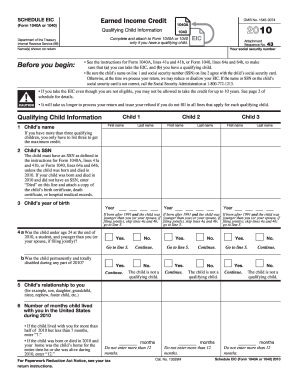

Schedule EIC (1040 Form)

What is Schedule EIC (1040 Form)?

Schedule EIC (1040 Form) is a tax form used by individuals who are eligible to claim the Earned Income Credit (EIC). The EIC is a refundable tax credit for low to moderate-income working individuals and families. It is designed to provide financial assistance to those who have earned income and meet specific eligibility criteria.

What are the types of Schedule EIC (1040 Form)?

There is only one type of Schedule EIC (1040 Form). It is a supplemental form that needs to be attached to the main Form 1040 when claiming the Earned Income Credit.

How to complete Schedule EIC (1040 Form)

Completing Schedule EIC (1040 Form) requires providing accurate information about your earned income, filing status, number of qualifying children, and other eligibility criteria. Here is a step-by-step guide to completing Schedule EIC:

By following these steps, you can accurately complete Schedule EIC (1040 Form) and ensure you claim the Earned Income Credit you are eligible for.