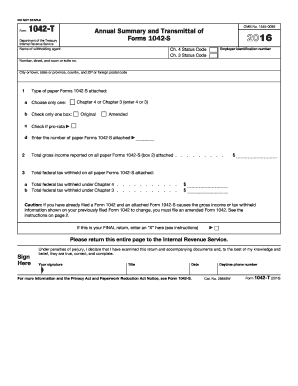

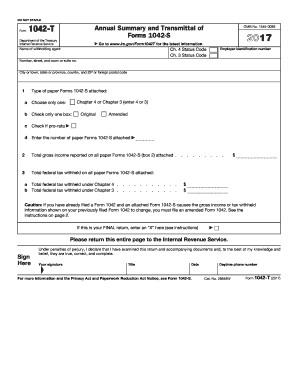

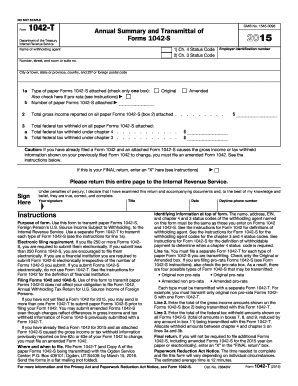

1042-T Form

What is 1042-T Form?

The 1042-T Form is a tax form used by foreign individuals who have received income from U.S. sources. It is used to report the tax withheld on income, such as interest, dividends, rents, royalties, or other fixed determinable annual or periodical gains, profits, or income.

What are the types of 1042-T Form?

There are three types of 1042-T Forms: 1. Form 1042-T: This is the standard form used to report tax withheld on income from U.S. sources. 2. Form 1042-T(A): This form is used by partnerships to allocate taxable income to foreign partners. 3. Form 1042-T(S): This form is used by withholding agents to report tax withheld on income from U.S. sources when the beneficial owner is a foreign person.

How to complete 1042-T Form

Completing the 1042-T Form is a simple process. Follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.