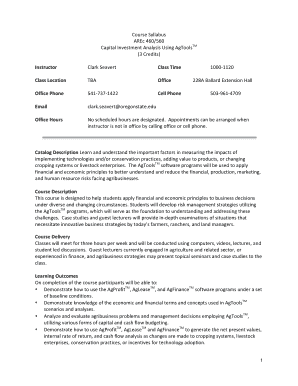

Investment Analysis Template

What is Investment Analysis Template?

Investment Analysis Template is a tool used by investors to evaluate the potential of an investment. It provides a structured framework for analyzing various factors such as return on investment, risk, market trends, and financial projections. By using an Investment Analysis Template, investors can make informed decisions and assess the profitability and viability of different investment opportunities.

What are the types of Investment Analysis Template?

There are several types of Investment Analysis Templates available, each designed to suit specific investment scenarios. Some common types of Investment Analysis Templates include:

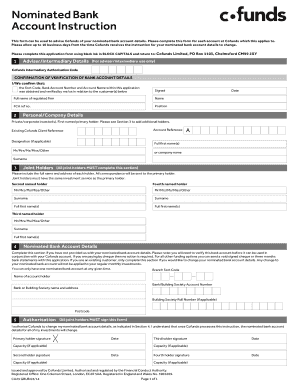

How to complete Investment Analysis Template

Completing an Investment Analysis Template can be done in a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.