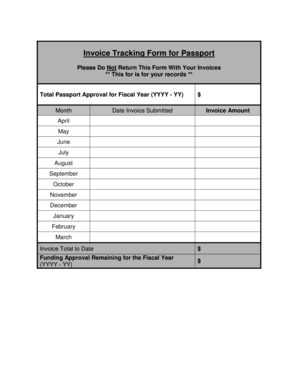

What is Invoice Tracking Template?

Invoice Tracking Template is a tool that helps businesses monitor and track their invoices. It provides a structured format for entering and organizing all the relevant information related to invoices, such as invoice numbers, dates, amounts, and payment statuses. By using an invoice tracking template, businesses can easily keep track of their invoices, ensure timely payments, and have a clear overview of their financial transactions.

What are the types of Invoice Tracking Template?

There are various types of Invoice Tracking Templates available, each designed to cater to different business needs. Some common types include:

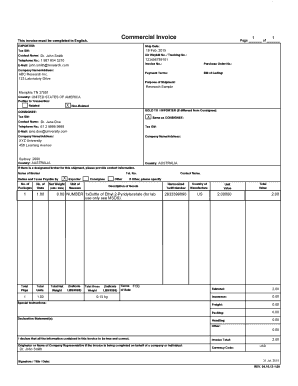

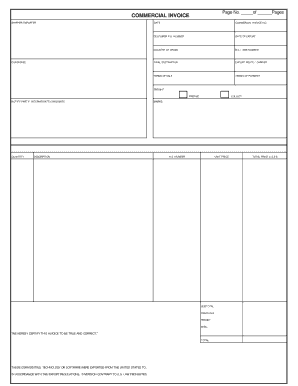

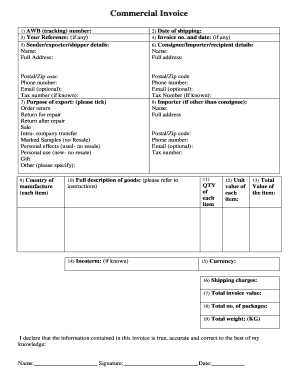

Basic Invoice Tracking Template: This template includes essential fields such as invoice number, date, customer details, amount, and status.

Advanced Invoice Tracking Template: This template offers more advanced features such as automated payment reminders, customizable reports, and integration with accounting software.

Project-based Invoice Tracking Template: This template is specifically designed for businesses that work on projects. It allows tracking invoices associated with specific projects and provides a comprehensive view of project-related financials.

How to complete Invoice Tracking Template

Completing an Invoice Tracking Template is a simple process. Here are the steps you can follow:

01

Start by downloading an Invoice Tracking Template that suits your business needs.

02

Open the template using a compatible software application such as Microsoft Excel or Google Sheets.

03

Enter the necessary details for each invoice, such as the invoice number, date, customer information, and amount.

04

Update the payment status regularly, marking invoices as paid or outstanding.

05

Utilize additional features offered by the template, such as automated calculations or customizable reports.

06

Save the completed template for future reference or sharing with other team members.

With pdfFiller, users can empower themselves to create, edit, and share documents online effortlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that fulfills all your document-related needs.