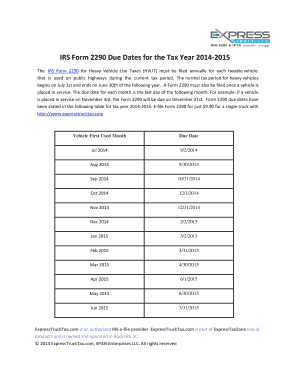

Irs Form 2290

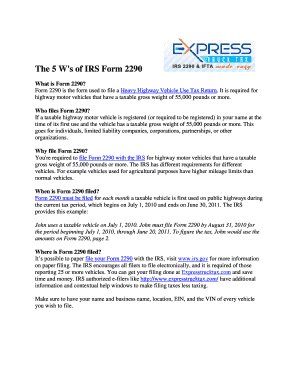

What is Irs Form 2290?

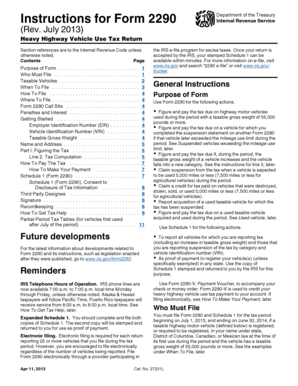

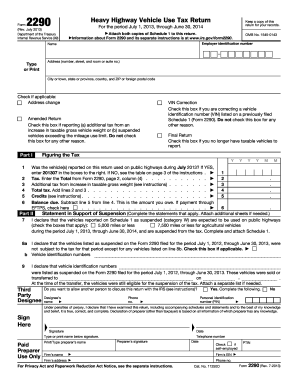

Irs Form 2290 is a federal tax form used by truck owners to report and pay the Heavy Highway Vehicle Use Tax (HVUT). This tax is applicable to vehicles with a gross weight of 55,000 pounds or more that are used on public highways. The form is filled out annually and submitted to the Internal Revenue Service (IRS) to ensure compliance with tax regulations.

What are the types of Irs Form 2290?

There are two types of Irs Form 2290 based on the method of payment and filing. These types are:

Paper Filing: In this method, the form is printed, filled out manually, and then mailed to the IRS. This option requires more time and effort as it involves physical paperwork and postage fees.

E-Filing: The preferred method for most truck owners, e-filing allows you to complete and submit the form electronically. This can be done through the IRS website or using an approved third-party service like pdfFiller.

How to complete Irs Form 2290

Completing Irs Form 2290 is a straightforward process. Here are the steps to follow:

01

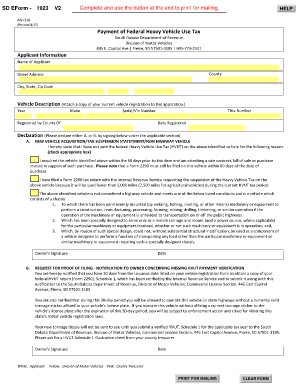

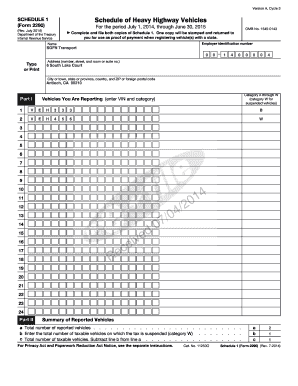

Gather your information: Before starting the form, make sure you have all the necessary details such as your Employer Identification Number (EIN), vehicle details including the Vehicle Identification Number (VIN), and the gross weight of each taxable vehicle.

02

Fill out the form: Enter the required information in the appropriate fields of the form. Be careful to provide accurate and complete information to avoid any discrepancies or delays in processing.

03

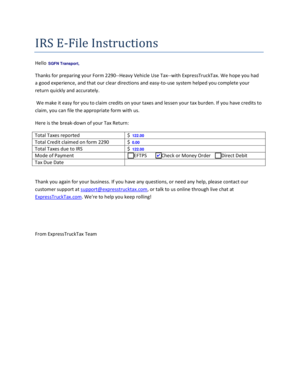

Choose your payment method: Decide whether you want to pay the tax amount through direct debit, Electronic Federal Tax Payment System (EFTPS), or by sending a check or money order along with the form.

04

Submit the form: Once you have filled out the form and chosen the payment method, review all the information for accuracy. Sign the form electronically if e-filing or physically if paper filing. Finally, submit the form to the IRS either electronically or through mail, depending on the chosen method.

05

Keep a copy for your records: As a best practice, make sure to keep a copy of the filled-out form and any accompanying documents for your reference and future audits.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Irs Form 2290

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I fill out a 2290 form?

To complete Form 2290, have the following information available. Your employer identification number (EIN). You must have an EIN to file Form 2290. You can't use your social security number. The vehicle identification number (VIN) of each vehicle. The taxable gross weight of each vehicle to determine its category.

How much does it cost to file 2290?

Annual Form 2290 Filing Vehicles on All Form 2290sAnnual Fee1 - 24 Vehicles$120.9925 – 100 Vehicles$217.79101 – 250 Vehicles$362.99251 – 500 Vehicles$399.292 more rows

How do I do my 2290 online?

What is IRS Form 2290? Create your FREE account with ExpressTruckTax. Enter your basic business details. Enter your EIN (Employer Identification Number) Enter your VIN (Vehicle Identification Number) Enter the gross weight of your vehicle (Combined gross weight) Choose your IRS payment method.

Can I file Form 2290 electronically?

More In Tax Pros You must e-file your Form 2290, Heavy Highway Vehicle Use Tax Return, if you are filing for 25 or more vehicles. However, we encourage e-filing for anyone required to file Form 2290 who wants to receive quick delivery of their watermarked Schedule 1.

How do you file Form 2290?

File Form 2290 electronically through any electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP) participating in the IRS e-file program for excise taxes. For more information on e-file, visit the IRS website at IRS.gov/e-File-Providers/e-File- Form-2290 or visit IRS.gov/Trucker.

Where do I file IRS Form 2290?

More In File If you are filing a Form 2290 paper return:Mail Form 2290 to:Without payment due or if payment is made through EFTPS or by credit/debit cardDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-00312 more rows • Aug 15, 2022

Related templates