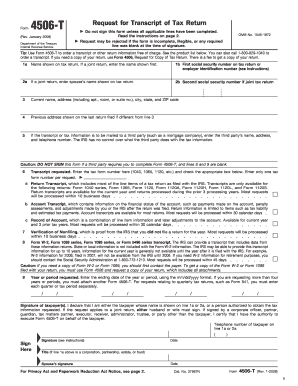

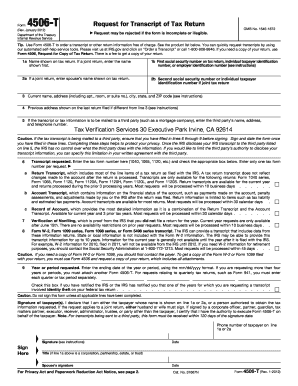

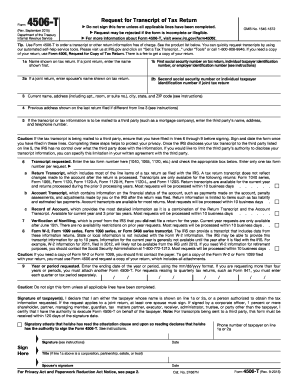

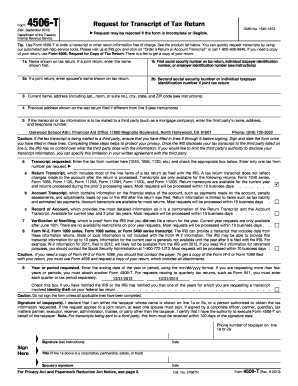

Irs Form 4506 T Verification Of Nonfiling

What is irs form 4506 t verification of nonfiling?

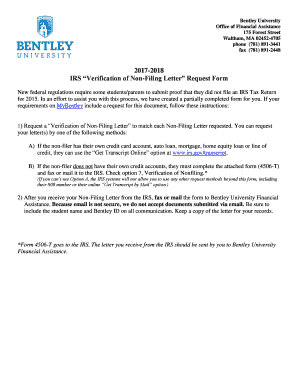

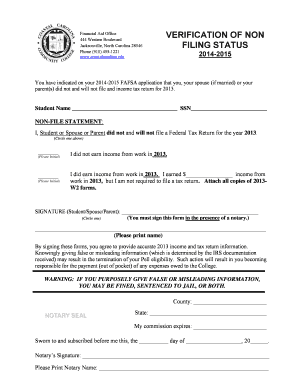

IRS Form 4506-T is a document used by individuals who need to verify their nonfiling status with the Internal Revenue Service (IRS). Nonfiling status means that the individual did not file a tax return for a specific year or years. This form is commonly requested by banks, financial institutions, and other organizations as proof of nonfiling.

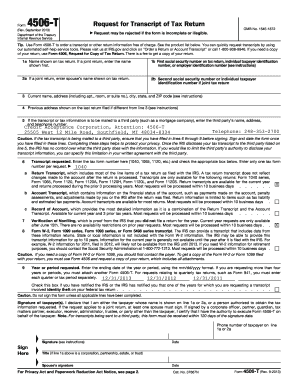

What are the types of irs form 4506 t verification of nonfiling?

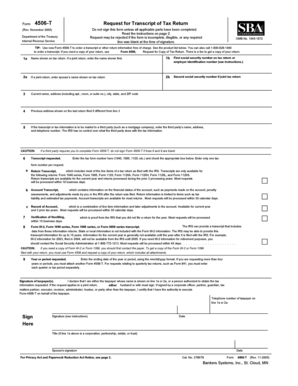

There are two types of IRS Form 4506-T for verification of nonfiling: the regular Form 4506-T and the Form 4506-T-EZ. The main difference between the two is that the Form 4506-T-EZ is a simplified version and can only be used to request a tax return transcript. The regular Form 4506-T, on the other hand, can be used to request various types of transcripts, including tax return transcripts, wage and income transcripts, and verification of nonfiling transcripts.

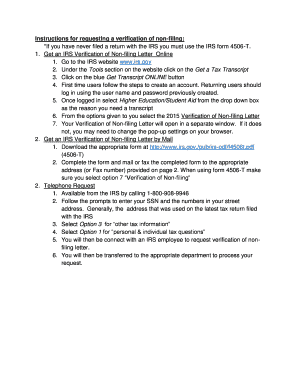

How to complete irs form 4506 t verification of nonfiling

Completing IRS Form 4506-T for verification of nonfiling is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.