Irs Tax Transcript Online

What is irs tax transcript online?

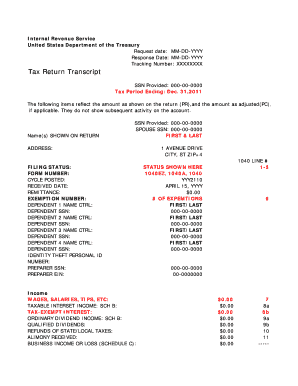

The IRS tax transcript online is a service provided by the Internal Revenue Service (IRS) that allows taxpayers to access and view their tax transcripts electronically. A tax transcript is a summary of a taxpayer's tax return information, including income, deductions, and credits. By accessing their tax transcripts online, taxpayers can quickly and conveniently review and verify their tax information without the need to wait for a paper copy to be mailed to them.

What are the types of irs tax transcript online?

The IRS offers several types of tax transcripts online, each providing different levels of detail and information. The main types of IRS tax transcripts available online include: 1. Tax Return Transcript: This transcript shows most line items from the original tax return, including any accompanying forms and schedules. 2. Tax Account Transcript: This transcript provides information about the taxpayer's tax account activity, such as payments, penalties, and interest. 3. Record of Account Transcript: This transcript combines the information from both the tax return transcript and tax account transcript into a single document.

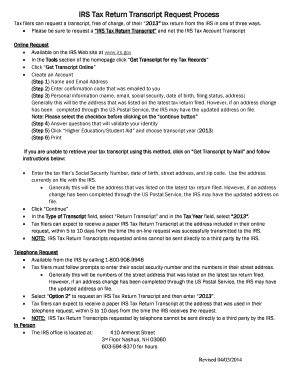

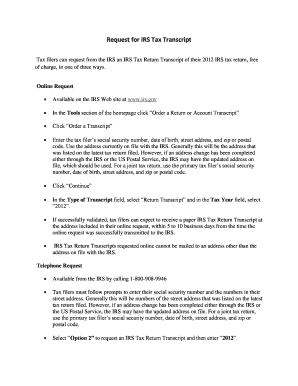

How to complete irs tax transcript online

Completing the IRS tax transcript online is a straightforward process. Follow these steps to complete your tax transcript online: 1. Visit the official IRS website and go to the 'Get Transcript' tool. 2. Click on the 'Get Transcript Online' option and create an account or log in using your existing credentials. 3. Select the type of tax transcript you need, such as the Tax Return Transcript or Tax Account Transcript. 4. Verify your identity by providing personal information, such as your Social Security number, date of birth, and filing status. 5. Review and confirm your transcript request. 6. Wait for the IRS to authenticate your request and provide you access to your tax transcript online. Remember to keep your login credentials secure and avoid accessing your tax transcript from public or unsecured networks.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.