Get the free agi meaning tax

Show details

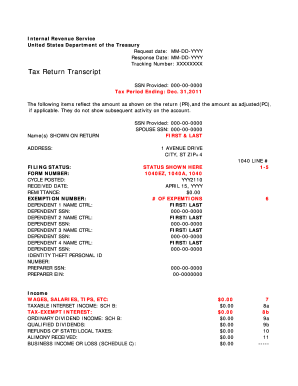

Internal Revenue Service United States Department of the Treasury Request date: MM-DD-YYYY Response Date: MM-DD-YYYY Tracking Number: XXXXXXXX Tax Return Transcript SSN Provided: 000-00-0000 Tax Period

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign where to find agi on tax return form

Edit your how to find your agi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your where to find my agi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit where to find your agi online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what is the agi on taxes form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

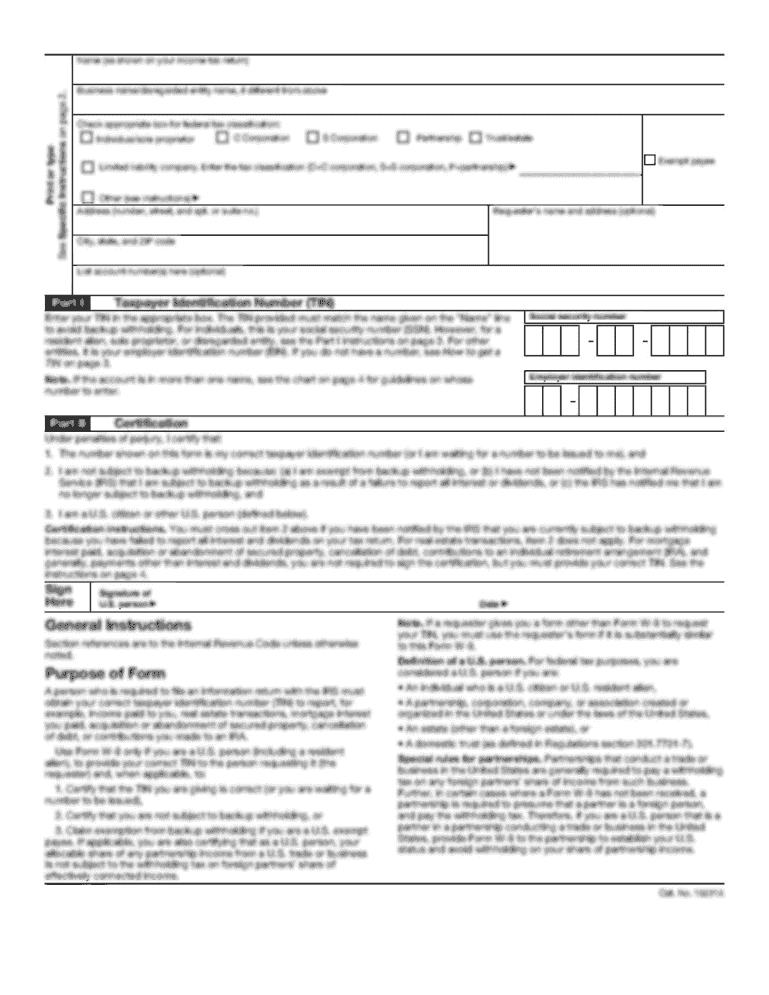

How to fill out agi on tax form

How to fill out 2019 tax decoder:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income or deduction statements.

02

Start by entering your personal details, including your name, address, and Social Security number, in the appropriate sections of the tax decoder form.

03

Follow the instructions provided on the form to accurately report your income. This may involve entering information from your W-2 forms or 1099 forms into the corresponding sections of the decoder.

04

Deductions and credits can significantly reduce your tax liability. Make sure to carefully review the form's instructions to identify which deductions and credits you may be eligible for, and accurately report them on the decoder.

05

Double-check all the information you have entered to ensure accuracy. Any mistakes can lead to errors or delays in processing your tax return.

06

Once you have completed all the necessary sections and verified the accuracy of your information, sign the form and submit it to the appropriate tax authority.

Who needs 2019 tax decoder?

01

Individuals who earned income during the year and are required to file a federal income tax return.

02

Self-employed individuals who need to report their business income and expenses.

03

Individuals who have investments or receive income from rental properties or other sources outside of employment.

04

Anyone who wants to claim deductions or credits to minimize their tax liability.

05

Tax professionals or accountants who assist others in preparing their tax returns.

Fill

where do you find your agi on your tax return

: Try Risk Free

People Also Ask about what is agi taxes

How do I get my 2019 tax return transcript?

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information. If you're trying to get a transcript to complete FAFSA, refer to tax Information for student financial aid applications.

Can I download 2019 tax forms?

At this point, use the 2019 Tax Calculator to assist you in completing your 2019 IRS Tax Forms for free. Then, click on the forms below and they will load into a PDF editor where you can complete, sign, and download or share the forms.

Can 2019 1040x be filed?

Can I file an amended Form 1040-X electronically? You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR.

Is 1040x available for 2019?

You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR.

Can I view my 2019 taxes online?

Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

How do I look up my 2019 tax return?

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund.

How do I download 2019 taxes?

To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2022, the IRS charges $43 for each return you request.

How can I download my 2019 tax return?

The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

How can I see my 2019 tax return online?

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Select the “Tax Return Transcript” and use only the “Adjusted Gross Income” line entry.

What type of tax transcript is needed for FAFSA?

Federal regulations require financial aid offices to collect IRS tax return transcripts for verification of FAFSA data. Provided below are different methods for obtaining your free IRS tax return transcript.

What line is total income on 1040 for 2019?

Line 8b on Form 1040 and 1040-SR (2019 tax year)

What is a 2019 tax transcript?

An IRS transcript is a record of your past tax returns. You can choose to receive them online or by mail. Request a transcript from the IRS website.

What do the codes mean on tax transcript?

The cycle code on your tax transcript means your return has been sent to the IRS master file (IMF). Additionally, this indicates the IRS is currently reviewing your submitted tax return. Your cycle code's first four digits reveal the year the tax is processed, while the fifth and sixth digits represent the week.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify where is agi located on tax return without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your how to find agi on tax return into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in where is your agi on your tax return?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your agi taxes meaning to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit agi location on 1040 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing how to find the agi on tax return right away.

What is tax decoder?

Tax decoder is a tool or software that helps individuals or businesses to calculate and decode their taxes.

Who is required to file tax decoder?

Any individual or business entity that has income or transactions subject to taxation is required to file tax decoder.

How to fill out tax decoder?

Tax decoder can be filled out by entering all relevant financial information, income sources, deductions, and credits in the designated fields.

What is the purpose of tax decoder?

The purpose of tax decoder is to accurately calculate the amount of taxes owed or refunded based on the financial information provided.

What information must be reported on tax decoder?

Tax decoder requires reporting of income, deductions, credits, and other financial information relevant to tax calculation.

Fill out your agi meaning tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agi Meaning Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.