What is loan agreement letter?

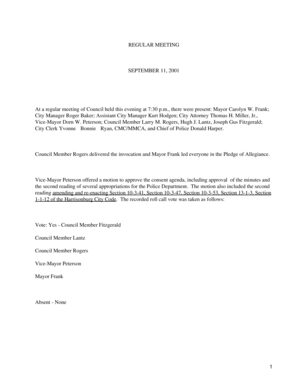

A loan agreement letter is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a written record of the agreement and helps protect the rights and interests of both parties involved.

What are the types of loan agreement letter?

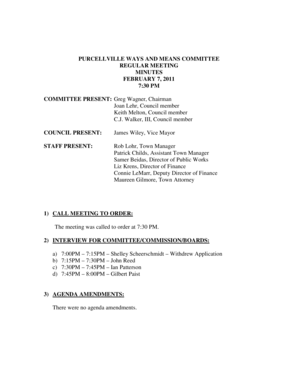

There are several types of loan agreements that can be used depending on the specific situation and the nature of the loan. Some common types include:

Secured Loan Agreement: In this type of agreement, the borrower provides collateral as security for the loan.

Unsecured Loan Agreement: This agreement does not require any collateral and is based solely on the borrower's creditworthiness.

Promissory Note: This is a simple agreement that includes the borrower's promise to repay the loan.

Installment Loan Agreement: This type of agreement outlines the repayment terms, including the amount of each installment and the payment schedule.

Demand Loan Agreement: This agreement allows the lender to demand full repayment of the loan at any time.

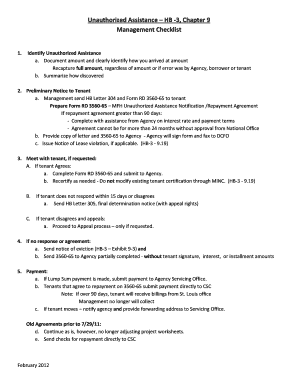

How to complete loan agreement letter

Completing a loan agreement letter involves several key steps to ensure that all the necessary information is included and that both parties understand and agree to the terms. Here is a step-by-step guide to completing a loan agreement letter:

01

Identify the parties involved: Clearly state the names and contact information of both the lender and the borrower.

02

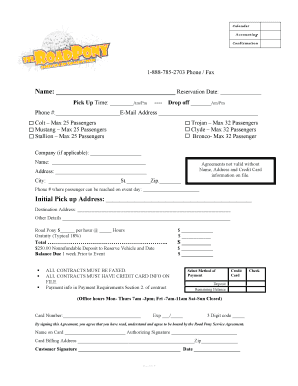

Specify the loan amount: Clearly state the amount of money being loaned.

03

Define the repayment terms: Include details such as the interest rate, repayment schedule, and any late payment penalties.

04

Outline the collateral (if applicable): If the loan is secured, describe the collateral being used to secure the loan.

05

Include any additional terms and conditions: This can include clauses for early repayment, default, or any other specific conditions agreed upon.

06

Sign and date the agreement: Both parties should sign and date the agreement to indicate their acceptance of the terms.

In summary, a loan agreement letter is a legally binding document that outlines the terms and conditions of a loan. By following the steps outlined in this guide, you can complete a comprehensive loan agreement letter that ensures the rights and interests of both the lender and borrower are protected.