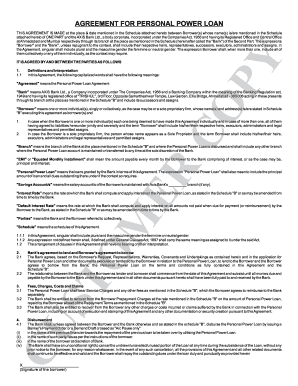

What is Personal Loan Agreement?

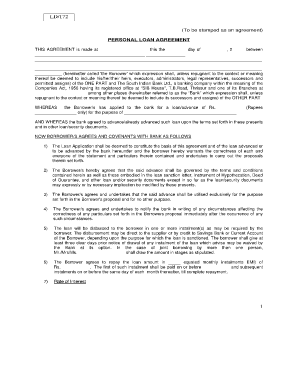

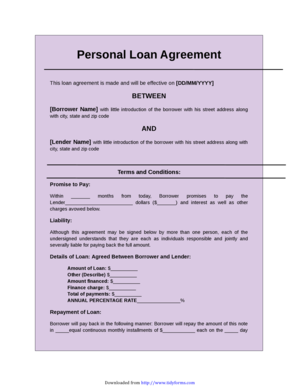

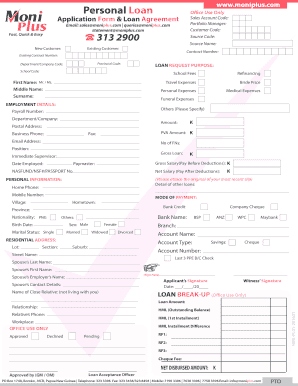

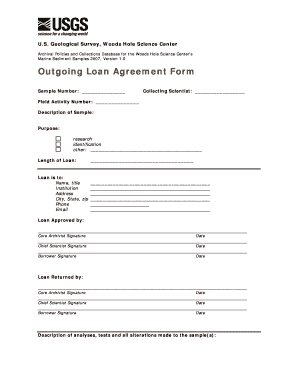

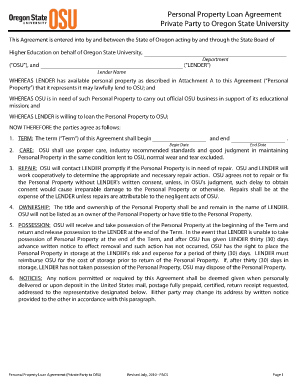

A Personal Loan Agreement is a legal contract between a borrower and a lender that outlines the terms and conditions of a personal loan. It includes important details such as the loan amount, interest rate, repayment schedule, and any penalties or fees for late payments. This agreement ensures that both parties are aware of their rights and obligations to protect their interests.

What are the types of Personal Loan Agreement?

There are various types of Personal Loan Agreements available depending on the specific needs and circumstances of the borrower. Here are a few common types:

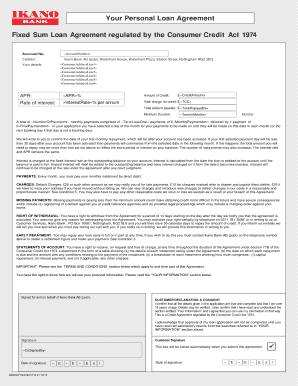

Fixed-Rate Personal Loan Agreement: This type of agreement has a fixed interest rate throughout the loan term, providing borrowers with predictable monthly payments.

Variable-Rate Personal Loan Agreement: In this type of agreement, the interest rate can change over time based on market conditions. Borrowers may experience fluctuations in their monthly payments.

Secured Personal Loan Agreement: This agreement requires the borrower to provide collateral, such as a property or vehicle, to secure the loan. If the borrower fails to repay the loan, the lender can seize the collateral to recover the funds.

Unsecured Personal Loan Agreement: Unlike a secured loan, an unsecured loan doesn't require collateral. However, lenders may charge higher interest rates to compensate for the increased risk.

Co-Signed Personal Loan Agreement: This agreement involves a co-signer who assumes responsibility for the loan if the borrower defaults. A co-signer with good credit can help borrowers secure better loan terms.

Payday Loan Agreement: Payday loans are short-term loans that are typically repaid on the borrower's next payday. These loans often come with high interest rates and fees.

How to complete Personal Loan Agreement

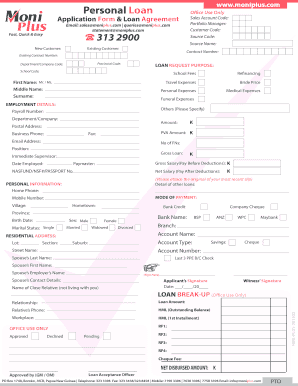

Completing a Personal Loan Agreement involves several steps to ensure that all the necessary information is accurately provided. Here's a simple guide to help you:

01

Gather all the required information, including personal details, loan terms, and any additional terms or conditions.

02

Fill in the loan amount, interest rate, and repayment schedule as agreed upon by both parties.

03

Include any specific terms or conditions that are relevant to the loan, such as late payment penalties or early repayment options.

04

Review the agreement carefully to ensure that all information is accurate and complete.

05

Both the borrower and lender should sign the agreement to make it legally binding.

06

Make copies of the signed agreement for both parties to keep as a record.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.