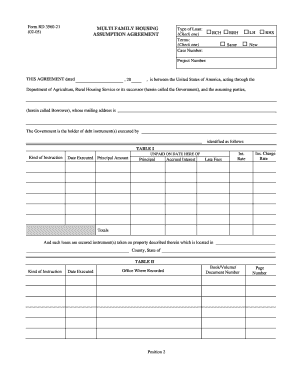

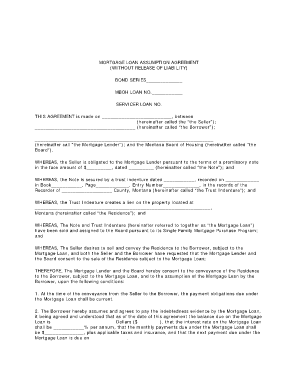

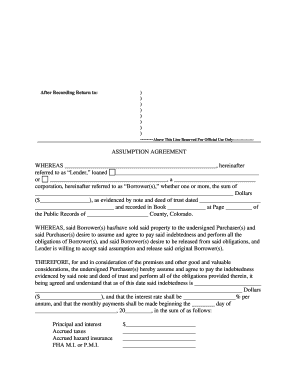

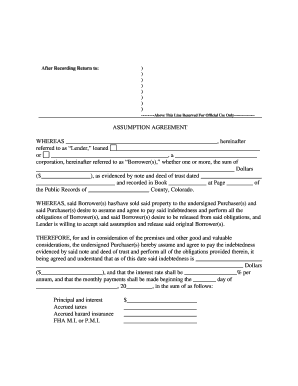

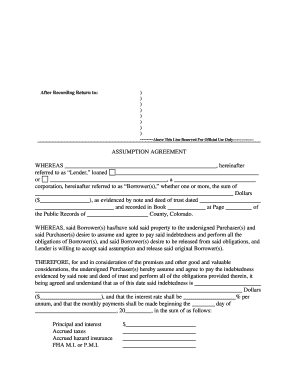

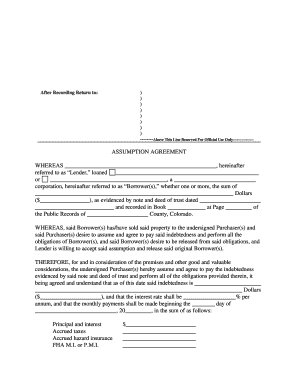

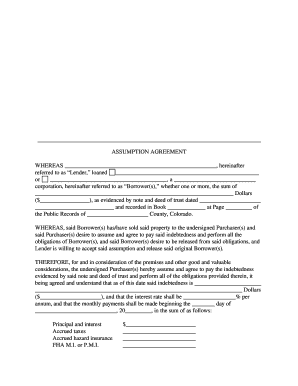

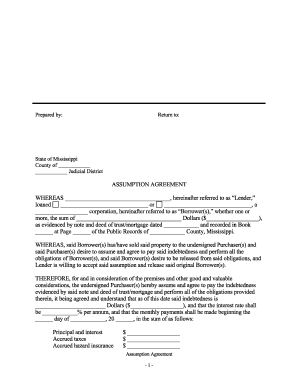

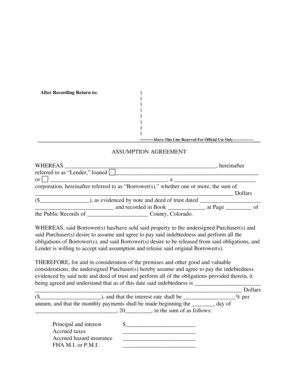

Loan Assumption Agreement Form

What is loan assumption agreement form?

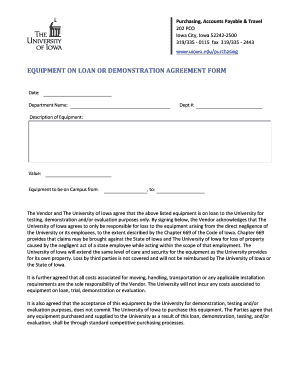

A loan assumption agreement form is a legal document that allows one party to take over the responsibility for an existing loan. This form is used when the original borrower wants to transfer the loan to another person or entity, relieving themselves of the obligation to repay the loan.

What are the types of loan assumption agreement form?

There are two main types of loan assumption agreement forms: 1. Simple Loan Assumption Agreement Form: This form is used when the new borrower takes over the loan without any changes to the existing terms and conditions. The new borrower agrees to assume all the rights and responsibilities of the original borrower. 2. Subject-to Loan Assumption Agreement Form: This form is used when the new borrower agrees to take over the loan but wants to negotiate new terms and conditions with the lender. The new borrower becomes responsible for repaying the loan and may have different repayment terms compared to the original loan agreement.

How to complete loan assumption agreement form

Completing a loan assumption agreement form may seem daunting, but with the right information, it can be a straightforward process. Here are the steps to complete the form: 1. Obtain the loan assumption agreement form: You can find this form online or request it from your lender. 2. Read and understand the terms: Carefully review the terms and conditions of the existing loan agreement and any additional terms that may apply to the assumption. 3. Fill in the borrower's information: Provide your personal details, including name, address, and contact information. 4. Fill in the lender's information: Enter the lender's details, such as their name, address, and contact information. 5. Indicate the loan details: Specify the loan amount, interest rate, and remaining balance. 6. Sign and date the form: Both the original borrower and the new borrower must sign and date the agreement. 7. Submit the form: Send the completed form to the lender for review and approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.