Loan Proposal For Small Business Template

What is Loan Proposal For Small Business Template?

A Loan Proposal For Small Business Template is a document that outlines a business owner's request for financial assistance from a lender or investor. It includes information about the business, its financials, and how the loan will be utilized. By using a template, business owners can ensure that they include all the necessary details and present a professional proposal to potential lenders or investors.

What are the types of Loan Proposal For Small Business Template?

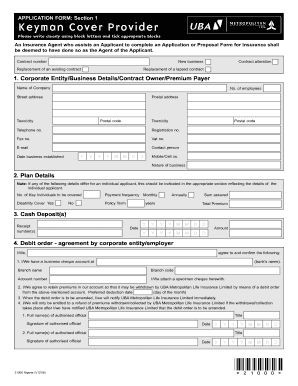

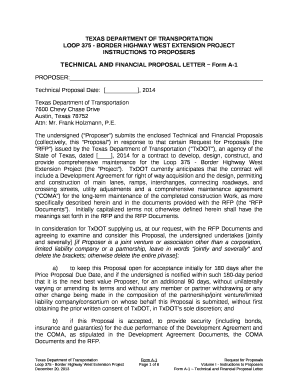

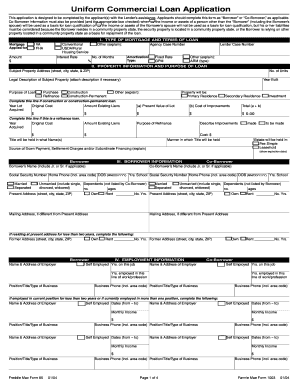

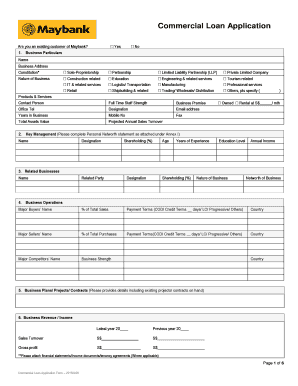

There are several types of Loan Proposal For Small Business Templates available, each catering to different business needs and lending requirements. Some common types include:

How to complete Loan Proposal For Small Business Template

Completing a Loan Proposal For Small Business Template is simple if you follow these steps:

pdfFiller is an innovative online platform that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for all your document needs. Whether you're creating a Loan Proposal For Small Business or any other document, pdfFiller provides a seamless and user-friendly experience to help you get your documents done efficiently.