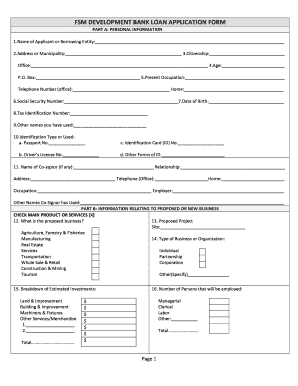

What is a Loan Proposal Template?

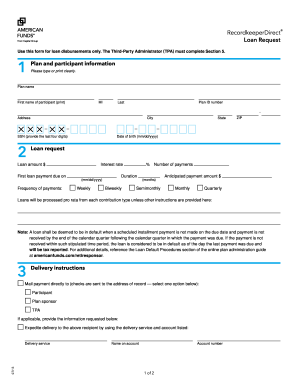

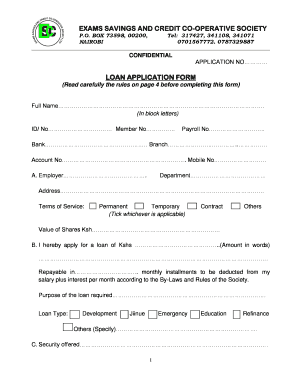

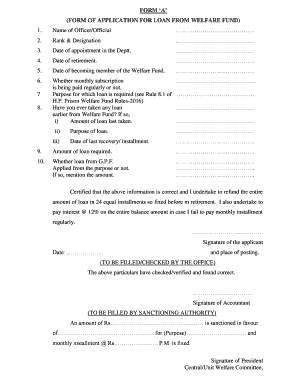

A Loan Proposal Template is a pre-designed document that outlines the details of a loan request. It provides a structured format for borrowers to present their loan application to lenders or financial institutions. The template includes sections for the borrower's personal and financial information, the purpose of the loan, repayment plans, and other relevant details. By using a Loan Proposal Template, borrowers can ensure that they include all the necessary information and present a professional loan request.

What are the types of Loan Proposal Template?

There are several types of Loan Proposal Templates available, depending on the nature of the loan request. Some common types include:

Commercial Loan Proposal Template: Used for business-related loan applications, such as loans for starting a new business, expanding an existing business, or purchasing equipment.

Personal Loan Proposal Template: Designed for individuals seeking personal loans for various purposes, such as debt consolidation, home improvements, or education.

Mortgage Loan Proposal Template: Specifically tailored for mortgage loan applications for purchasing or refinancing a property.

Small Business Loan Proposal Template: Created for small business owners who need funding for their ventures or working capital.

Project Loan Proposal Template: Suitable for project-based loan applications, such as construction or infrastructure projects.

How to complete a Loan Proposal Template?

Completing a Loan Proposal Template can be a straightforward process if you follow these steps:

01

Fill in your personal and contact information, including your name, address, phone number, and email.

02

Provide details about the loan purpose, such as the amount of funding needed, specific project details (if applicable), and a brief explanation of how the loan will be used.

03

Include information about your financial situation, such as your income, assets, debts, and credit score.

04

Outline your repayment plan, including the proposed terms and conditions, interest rate, and the duration of the loan.

05

Attach any supporting documents, such as financial statements, business plans, or collateral information, that strengthen your loan application.

06

Review the completed Loan Proposal Template for accuracy and completeness before submitting it to the lender or financial institution.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.