Real Estate Loan Proposal Template

What is Real Estate Loan Proposal Template?

A Real Estate Loan Proposal Template is a pre-designed document that helps individuals or businesses apply for a loan for real estate purposes. It provides a structured format for presenting the necessary information to potential lenders, such as the loan amount, repayment terms, and collateral.

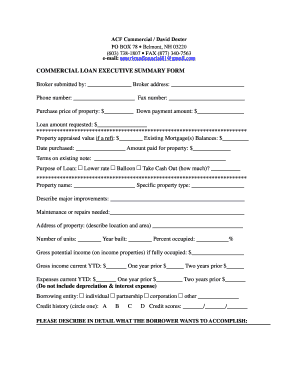

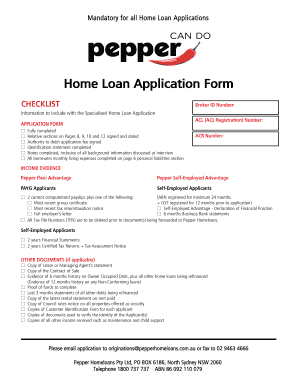

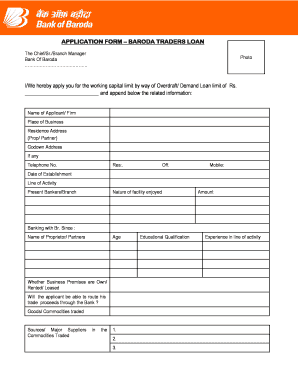

What are the types of Real Estate Loan Proposal Template?

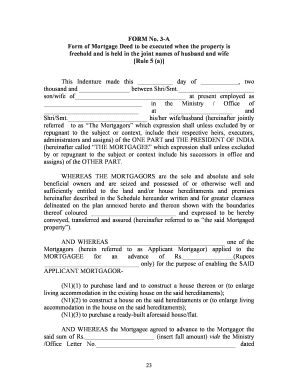

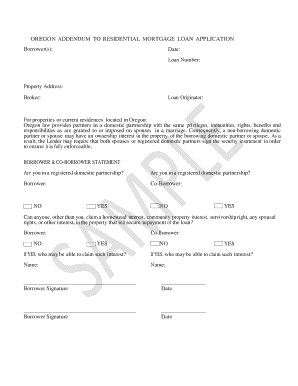

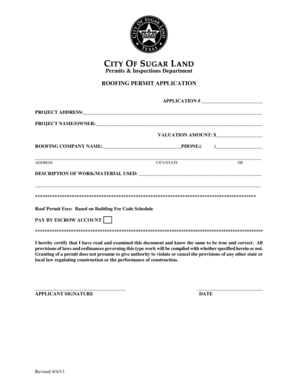

There are several types of Real Estate Loan Proposal Templates available, each tailored to specific real estate financing needs. Some common types include: 1. Residential Loan Proposal Template: Used for obtaining a loan for residential properties such as houses and apartments. 2. Commercial Loan Proposal Template: Designed for securing financing for commercial properties like office buildings, retail spaces, or industrial facilities. 3. Construction Loan Proposal Template: Used when seeking funding for new construction projects or major renovations. 4. Investment Loan Proposal Template: Designed specifically for real estate investments, such as rental properties or fix-and-flip ventures. 5. Land Loan Proposal Template: Used when applying for a loan to purchase vacant land for development or investment purposes.

How to complete Real Estate Loan Proposal Template

Completing a Real Estate Loan Proposal Template involves the following steps: 1. Start by providing your contact information, including your name, address, phone number, and email. 2. Clearly state the purpose of the loan, whether it is to purchase a property, fund a construction project, or finance an investment. 3. Describe the property or project in detail, including its location, size, and any unique features. 4. Specify the loan amount you are seeking and the desired terms, such as the interest rate, repayment period, and any collateral you can offer. 5. Include a detailed financial statement that highlights your income, assets, and liabilities. 6. Provide any additional supporting documents that may be required, such as bank statements, tax returns, or property appraisals. 7. Review the completed proposal for accuracy and make any necessary revisions. 8. Finally, sign and submit the proposal to the lender for review and consideration.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.