Personal Loan Proposal Template

What is Personal Loan Proposal Template?

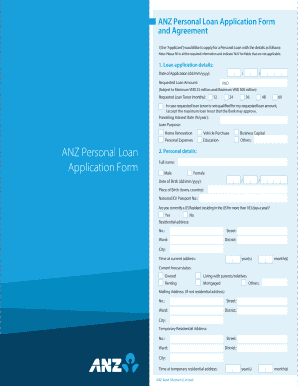

A Personal Loan Proposal Template is a pre-designed document that provides a framework for individuals or organizations who are seeking a loan. It contains the necessary information and sections needed to present a comprehensive loan proposal to potential lenders. By using a template, borrowers can save time and ensure that all relevant information is included in their proposal.

What are the types of Personal Loan Proposal Template?

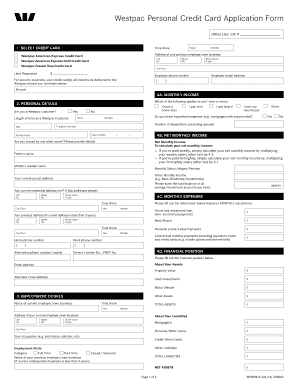

Personal Loan Proposal Templates come in various formats and styles, catering to different loan requirements. Here are some common types:

How to complete Personal Loan Proposal Template

Completing a Personal Loan Proposal Template is an easy and straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.