Small Business Loan Proposal Template

What is Small Business Loan Proposal Template?

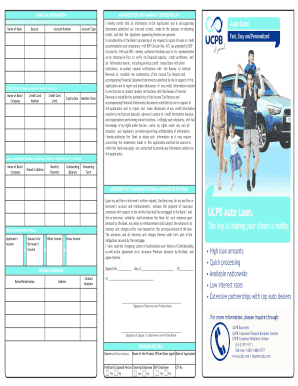

A Small Business Loan Proposal Template is a document that outlines the details and requirements of a loan proposal for a small business. It includes information about the business, the purpose of the loan, the amount requested, and how the loan will be used. This template serves as a guide for small business owners to create a professional and comprehensive loan proposal.

What are the types of Small Business Loan Proposal Template?

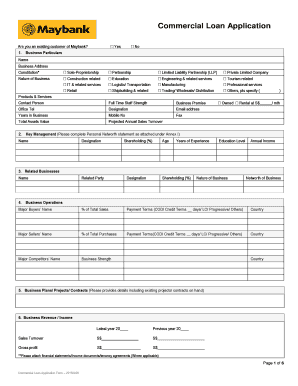

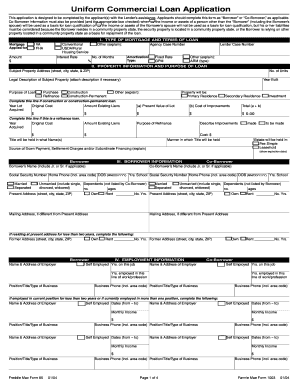

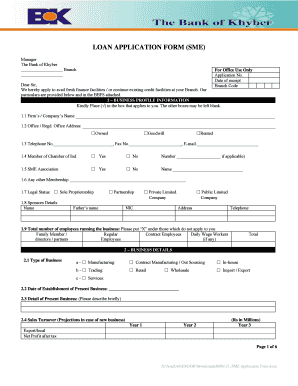

There are various types of Small Business Loan Proposal Templates available to suit different business needs. Some common types include: 1. Traditional Business Loan Proposal Template: This template is suitable for businesses looking to secure a loan through a traditional lending institution, such as a bank. 2. SBA Loan Proposal Template: SBA (Small Business Administration) loan proposals are specifically designed for businesses seeking funding through SBA programs. 3. Startup Loan Proposal Template: For startups and new businesses, this template focuses on presenting the business idea and financial projections to attract funding. 4. Equipment Loan Proposal Template: This template is tailored for businesses that require funding specifically for purchasing or leasing equipment.

How to complete Small Business Loan Proposal Template

Completing a Small Business Loan Proposal Template can be a straightforward process if you follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.