SBA 5C 2015 free printable template

Show details

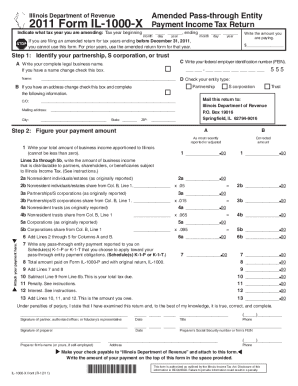

Source I own 20 or more of a corporation partnership limited partnership or LLC SBA Form 5C 02-15 Ref SOP 50 30 Use back page for additional comments or information if necessary DAMAGED PROPERTY ADDRESS Is this your primary residence Same as applicant mailing address Damage type Real Estate Personal Property Auto Homeowner s Insurance Company Name Type of insurance coverage in force for this loss Automobile Renter s 8. SBA will contact you by phone or Email to discuss your loan request....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SBA 5C

Edit your SBA 5C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SBA 5C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SBA 5C online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SBA 5C. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 5C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SBA 5C

How to fill out SBA 5C

01

Begin with your personal information on the top of the form, including your name, address, and Social Security number.

02

In the 'Business Information' section, provide details about your business, such as its legal name, address, and the type of business.

03

Fill out the 'Loan Request' section, specifying the amount of financing you are seeking and how you plan to use the funds.

04

Complete the 'Personal Financial Statement' with your assets, liabilities, income, and expenses.

05

Review the 'Ownership and Management' section to ensure that all owners and key management personnel are listed.

06

Sign and date the form at the bottom, certifying that all information provided is accurate.

Who needs SBA 5C?

01

Small business owners seeking financial assistance from the Small Business Administration (SBA).

02

Entrepreneurs looking to apply for an SBA loan for various business purposes.

03

Individuals interested in acquiring a small business or seeking funding for startup ventures.

Fill

form

: Try Risk Free

People Also Ask about

Do SBA loans need to be paid back?

Your Loan Will Go Into Default If you stop paying on your loan, it will go into default. The amount of time you have to pay before defaulting depends on the terms of your SBA loan contract. Though, in general, you will have between 90–120 days to resume payments.

What is an SBA loan?

The SBA helps small businesses obtain needed credit by giving the government's guaranty to loans made by commercial lenders. The lender makes the loan and SBA will repay up to 85% of any loss in case of default. Since this is a bank loan, applications are submitted to the bank and loan payments are paid to the bank.

What is an SBA form?

The purpose of this form is to collect information about the Small Business Applicant ("Applicant") and its owners, the loan request, existing indebtedness, information about current or previous government financing, and certain other topics.

Who qualifies as SBA?

Eligibility requirements Operate for profit. Be engaged in, or propose to do business in, the U.S. or its territories. Have reasonable owner equity to invest. Use alternative financial resources, including personal assets, before seeking financial assistance.

What is the easiest SBA loan to get?

SBA Express This term loan or line of credit offers fixed or variable SBA loan rates as well as the easiest SBA application process, quick approval times, flexible terms, and lower down payment requirements than conventional loans.

Is it hard to get a SBA loan?

The short answer – No, it is not hard to get an SBA loan! Most businesses are eligible and qualifying is easier than you might think! The SBA 504 loan is specifically designed to help small businesses expand by purchasing fixed assets such as real estate and equipment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SBA 5C?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SBA 5C in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the SBA 5C in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your SBA 5C in seconds.

How do I fill out SBA 5C using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign SBA 5C and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is SBA 5C?

SBA 5C refers to a form used by the Small Business Administration (SBA) to gather essential information about small business borrowers, particularly regarding their character, capacity, capital, collateral, and conditions, known as the '5 Cs of Credit'.

Who is required to file SBA 5C?

Businesses seeking financing through SBA loan programs are required to file SBA 5C, particularly those applying for loans that involve personal guarantees from business owners.

How to fill out SBA 5C?

To fill out SBA 5C, gather necessary personal and business financial information, complete the form by providing accurate details regarding the business structure, financial condition, and history, and ensure all required signatures are included before submission.

What is the purpose of SBA 5C?

The purpose of SBA 5C is to assess the creditworthiness of a business applicant by evaluating critical factors that influence lending decisions, thereby enhancing the SBA's ability to evaluate risk.

What information must be reported on SBA 5C?

SBA 5C requires reporting of information such as personal and business financial statements, credit history, business structure, management experience, and any assets or liabilities pertinent to the lending decision.

Fill out your SBA 5C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SBA 5c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.