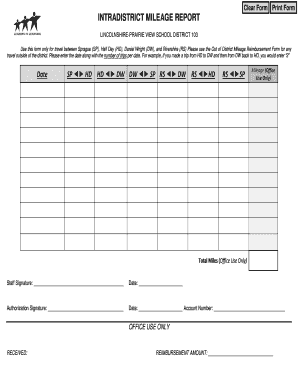

Mileage Form Excel

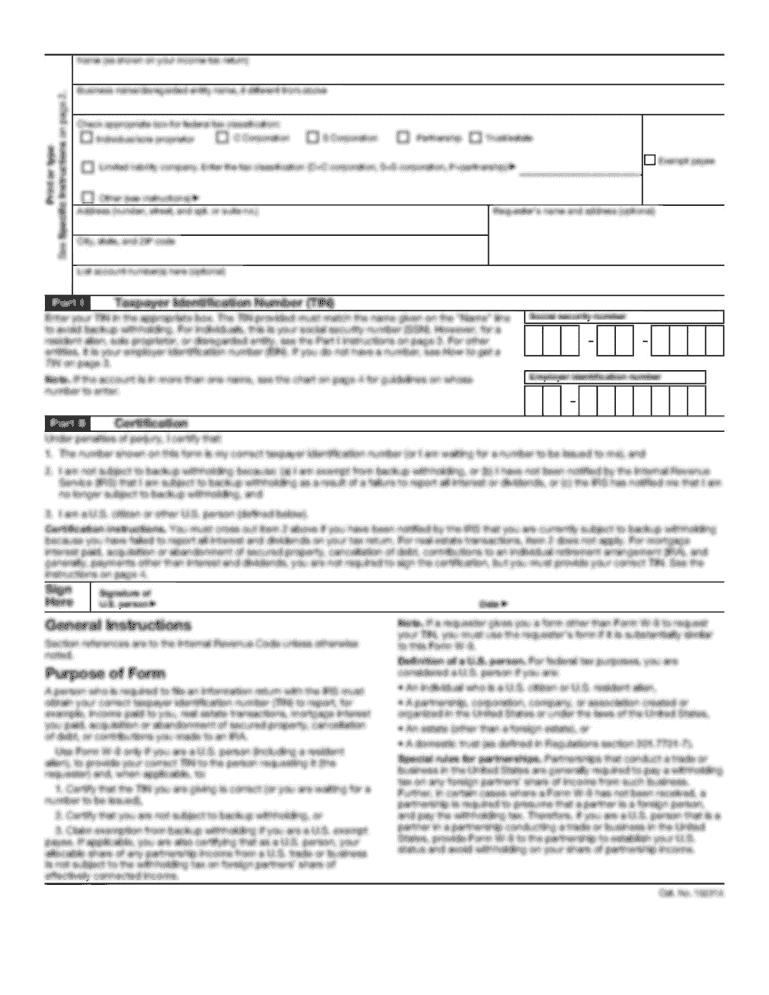

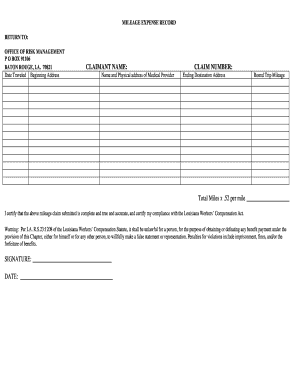

What is mileage form excel?

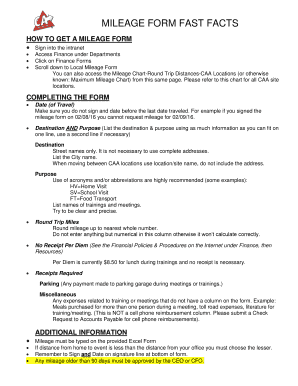

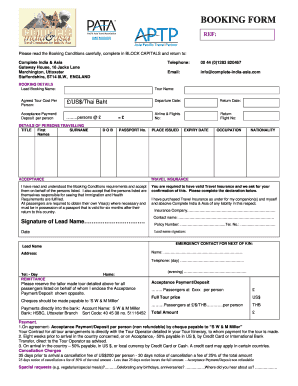

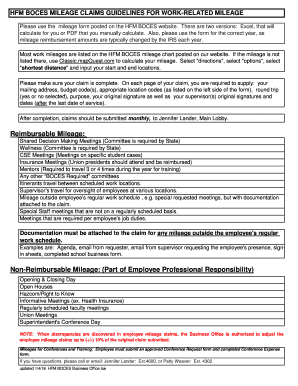

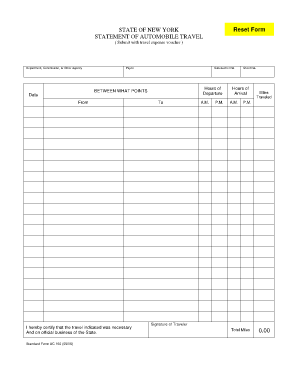

Mileage form Excel is a tool used to track and calculate the distance traveled for business or personal use. It helps individuals or businesses keep a record of the miles driven and expenses incurred for reimbursement or tax purposes.

What are the types of mileage form excel?

There are two main types of mileage forms in Excel: 1. Standard Mileage Rate Form - this form uses the standard mileage rate set by the IRS to calculate deductions for business-related mileage. 2. Actual Expenses Form - this form tracks all actual expenses related to vehicle use, such as gas, maintenance, insurance, and depreciation.

How to complete mileage form excel

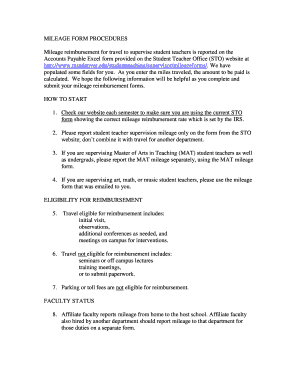

Completing a mileage form in Excel is easy with the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.