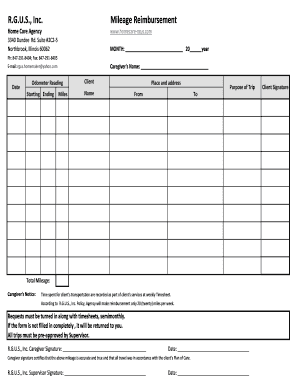

Mileage Reimbursement Form Pdf

What is mileage reimbursement form pdf?

A mileage reimbursement form PDF is a document that allows individuals to record and submit their travel expenses for reimbursement. It is especially useful for employees who frequently travel for work or for individuals who use their personal vehicles for business purposes. This form is typically required by employers or organizations to ensure proper documentation and accurate reimbursement of travel expenses.

What are the types of mileage reimbursement form pdf?

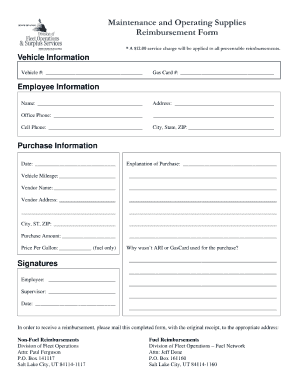

There are various types of mileage reimbursement form PDF available, each designed to cater to different purposes and requirements. Some common types include: 1. Standard mileage reimbursement form: This form is used to track and claim mileage based on the standard mileage rate set by the IRS. 2. Actual expenses reimbursement form: This form is used to record and claim actual expenses incurred during travel, such as fuel, tolls, parking fees, and maintenance costs. 3. Volunteer mileage reimbursement form: This form is specifically designed for volunteers who use their personal vehicles for charitable or non-profit activities. 4. Medical mileage reimbursement form: This form is used by individuals who need to claim mileage expenses related to medical treatments or visits. These forms provide a structured format for individuals to accurately report their travel expenses and ensure proper reimbursement.

How to complete mileage reimbursement form pdf

Completing a mileage reimbursement form PDF is a simple and straightforward process. Here is a step-by-step guide to help you: 1. Download the mileage reimbursement form PDF from a trusted source or use an online platform like pdfFiller. 2. Open the form using a PDF editor like pdfFiller. 3. Fill in the required personal information, such as your name, address, and contact details. 4. Provide the details of your travel, including the date of travel, starting and ending locations, purpose of travel, and the number of miles driven. 5. If required, provide additional information about the expenses incurred during travel, such as fuel expenses or toll fees. 6. Double-check all the information to ensure accuracy and completeness. 7. Save the completed form and submit it to the relevant person or organization for reimbursement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.