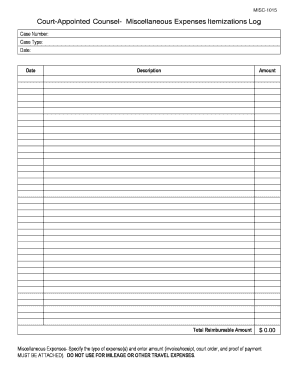

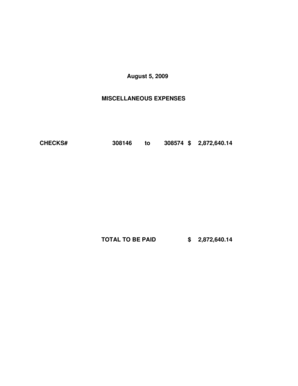

What is miscellaneous expenses?

Miscellaneous expenses refer to the costs that do not fall under specific categories or cannot be classified into any particular group. These expenses are usually small in nature and tend to vary from person to person. They can include a wide range of expenses such as small purchases, personal care items, entertainment expenses, and more.

What are the types of miscellaneous expenses?

There are several types of miscellaneous expenses that individuals may encounter. Some common types of miscellaneous expenses include:

Small purchases like stationery, office supplies, or daily convenience items.

Personal care items such as grooming products, toiletries, and cosmetics.

Entertainment expenses like movie tickets, concert tickets, or dining out.

Miscellaneous subscriptions or membership fees.

Unexpected or emergency expenses that don't fit into other categories.

How to complete miscellaneous expenses?

Completing miscellaneous expenses can be a straightforward process if you follow these steps:

01

Keep track of all your expenses: Maintain a record of every expense, no matter how small. This will help you identify and categorize your miscellaneous expenses more accurately.

02

Create a budget: Set aside a specific amount for miscellaneous expenses in your monthly budget. This will help you allocate funds and avoid overspending in this category.

03

Review and categorize your expenses: Regularly review your expense records and categorize the miscellaneous expenses accordingly. This will provide you with insights into your spending patterns and help you make better financial decisions.

04

Seek ways to minimize expenses: Look for opportunities to reduce your miscellaneous expenses. This could include prioritizing your purchases, comparing prices, or finding cost-effective alternatives.

05

Use online tools: Take advantage of online platforms like pdfFiller to create, edit, and share expense reports or budget templates. These tools can streamline the process and make it easier to manage your miscellaneous expenses.

With pdfFiller, you can easily create, edit, and share documents online, including expense reports or budget templates. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the all-in-one PDF editor that empowers users to efficiently handle their miscellaneous expenses and get their documents done with ease.