Monthly Bank Reconciliation - Page 2

What is Monthly Bank Reconciliation?

Monthly Bank Reconciliation is the process of comparing and matching the transactions recorded in an organization's accounting records with the transactions reported by the bank. It ensures that the company's records and the bank's records are in agreement and helps identify any discrepancies or errors.

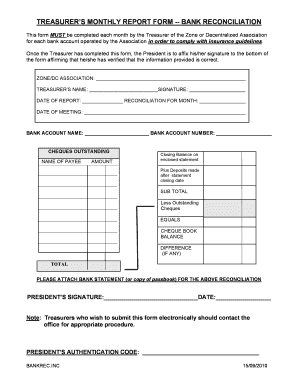

What are the types of Monthly Bank Reconciliation?

There are two main types of Monthly Bank Reconciliation: 1. Internal Reconciliation: This involves comparing the company's records with the bank's records and resolving any discrepancies or errors within the organization. It helps identify mistakes made by the company, such as incorrect entries or missing transactions. 2. External Reconciliation: This involves comparing the company's records with the bank's records and resolving any discrepancies or errors external to the organization. It helps identify mistakes made by the bank, such as missing deposits or incorrect bank charges.

How to complete Monthly Bank Reconciliation

Completing Monthly Bank Reconciliation requires the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.