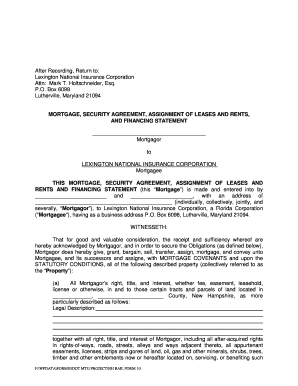

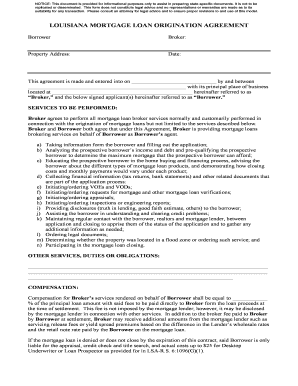

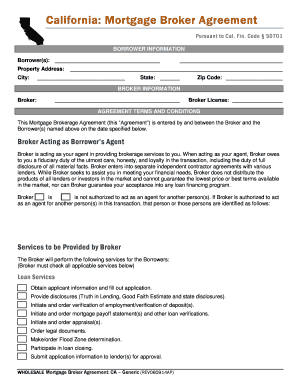

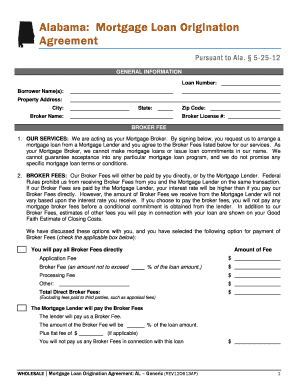

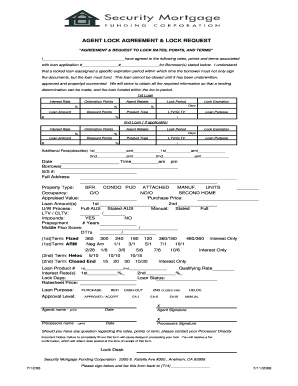

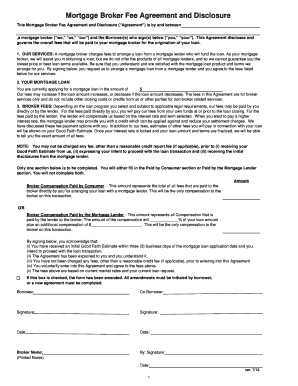

What is mortgage agreement format?

A mortgage agreement format is a document that outlines the terms and conditions of a mortgage loan. It serves as a legally binding contract between the borrower and the lender, detailing the rights and responsibilities of both parties. This agreement format typically includes information such as the loan amount, interest rate, repayment terms, and any additional clauses or provisions.

What are the types of mortgage agreement format?

There are several types of mortgage agreement formats available, depending on the specific requirements and preferences of the parties involved. Some common types include:

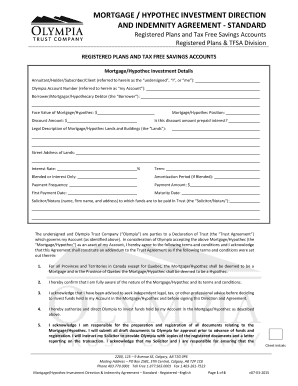

Fixed-rate mortgage agreement format: This type of agreement has a fixed interest rate throughout the loan term, offering stability and predictability for the borrower.

Adjustable-rate mortgage agreement format: In this format, the interest rate can vary over time based on market conditions, allowing for potential savings or increased costs for the borrower.

Balloon mortgage agreement format: This agreement format involves making smaller monthly payments for a certain period, followed by a larger payment (balloon payment) at the end of the loan term.

Interest-only mortgage agreement format: With this format, the borrower only pays the interest on the loan for a specified period, after which the principal amount comes into play.

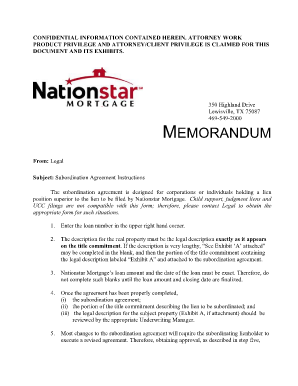

How to complete mortgage agreement format

Completing a mortgage agreement format requires careful attention to detail and adherence to the specific guidelines provided. Here are the general steps to follow:

01

Gather all necessary information: Collect all the required documents and information, including personal and financial details of the borrower and lender.

02

Review the agreement format: Carefully read through the mortgage agreement format to understand the terms and conditions, ensuring you are comfortable with the terms.

03

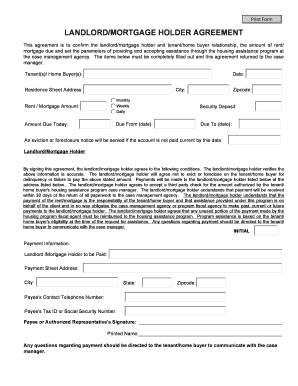

Fill in the blanks: Enter the relevant information into the designated fields of the agreement format, making sure to provide accurate and complete details.

04

Seek legal advice if needed: If you have any concerns or questions regarding the agreement, it is advisable to consult with a legal professional for guidance.

05

Sign and date the agreement: Once all the information is filled in and reviewed, sign and date the mortgage agreement format to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.