Mortgage Deed Pdf - Page 2

What is mortgage deed pdf?

A mortgage deed pdf is a legal document that outlines the terms and conditions of a mortgage loan. It includes detailed information about the property being mortgaged, the parties involved, and the repayment terms. The mortgage deed pdf serves as evidence of the borrower's liability to repay the loan and gives the lender a legal claim on the property in case of default.

What are the types of mortgage deed pdf?

There are several types of mortgage deed pdf that are commonly used:

General Warranty Deed: This type of mortgage deed provides the highest level of protection for the buyer, as the seller guarantees that the property is free from any liens or encumbrances.

Special Warranty Deed: With this type of mortgage deed, the seller guarantees that they have not caused any liens or encumbrances on the property during their ownership, but does not provide protection against any pre-existing claims.

Quitclaim Deed: This type of mortgage deed transfers the seller's interest in the property to the buyer, but offers no guarantees or warranties about the title of the property.

Deed of Trust: Unlike other mortgage deeds, a deed of trust involves three parties—the borrower, the lender, and a trustee. The trustee holds the legal title to the property until the loan is fully paid off or in case of default.

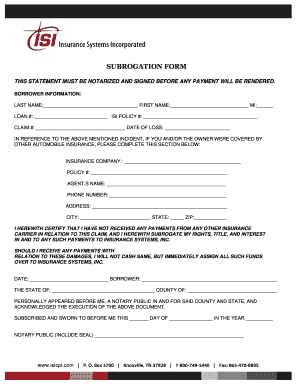

How to complete mortgage deed pdf

Completing a mortgage deed pdf requires careful attention to detail. Here are the steps to follow:

01

Check the accuracy of the mortgage deed pdf form: Ensure that all the information in the form is correct, including the names of the parties involved, the property details, and the terms of the mortgage.

02

Review any additional documents or requirements: Depending on the jurisdiction and the lender's policies, there may be additional documents or requirements that need to be fulfilled before the mortgage deed can be considered complete.

03

Sign the mortgage deed: Both the borrower and the lender must sign the mortgage deed in the presence of a notary public or other authorized individuals. Make sure to follow the signing instructions carefully.

04

Record the mortgage deed: After signing, the mortgage deed should be recorded with the appropriate government office to make it official and protect the lender's interest in the property.

05

Keep a copy for your records: It is essential to keep a copy of the completed mortgage deed pdf for your records and reference in the future.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself