Official Receipt Sample Philippines

What is official receipt sample philippines?

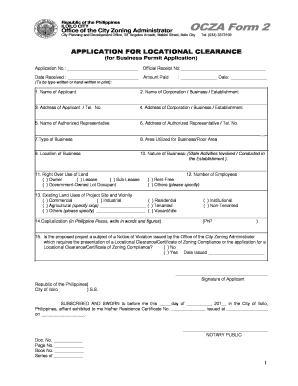

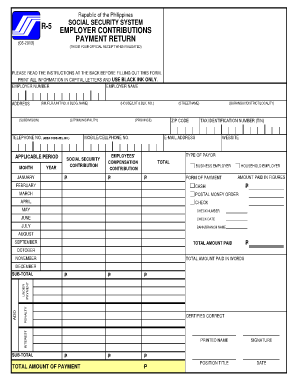

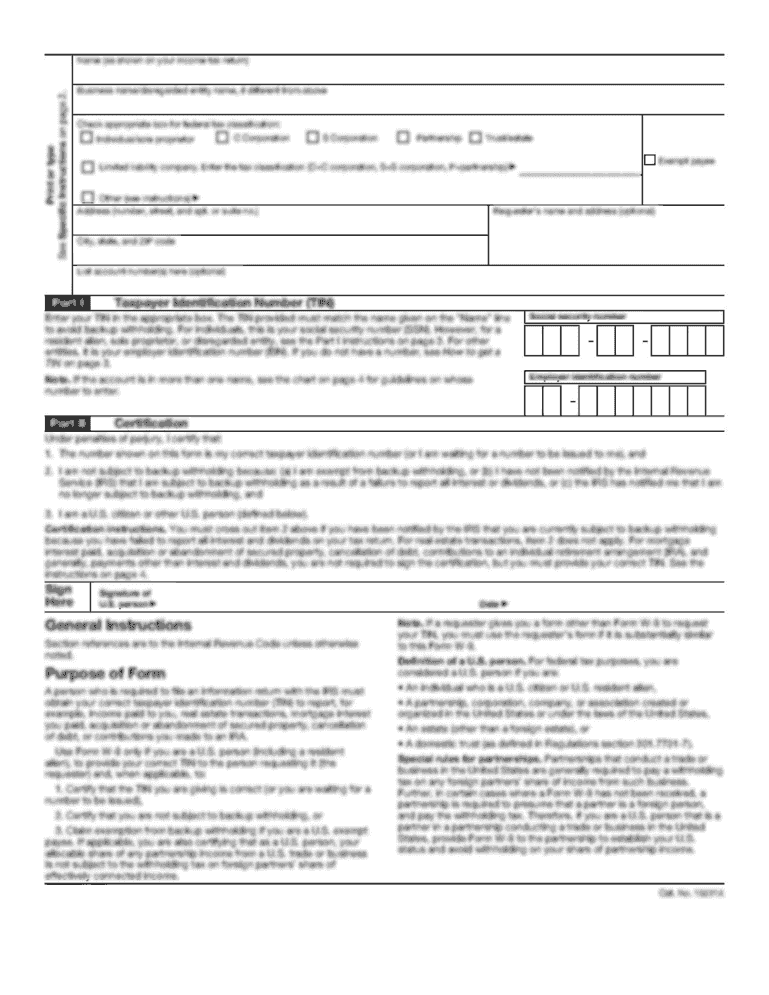

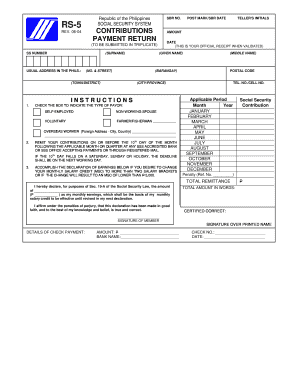

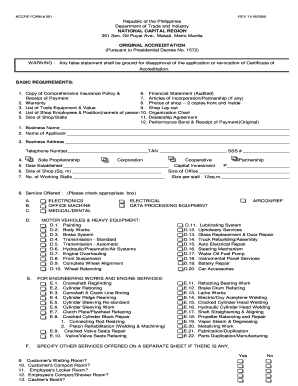

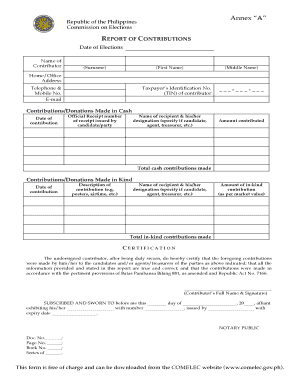

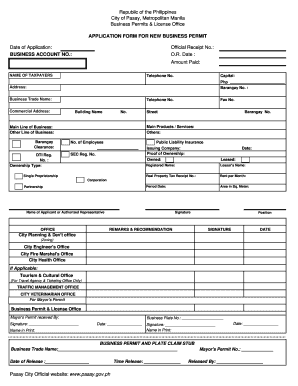

An official receipt sample in the Philippines is a document issued by a seller to a buyer as proof of payment for goods or services. It contains important details such as the seller's name, address, TIN (Tax Identification Number), and the buyer's name and address. The official receipt serves as a legal record and is required for bookkeeping and tax purposes.

What are the types of official receipt sample philippines?

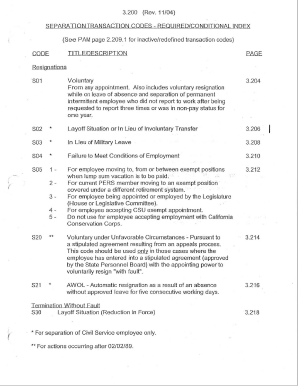

There are several types of official receipt samples in the Philippines based on the nature of the transaction and the business entity. Some common types include:

How to complete official receipt sample philippines

Completing an official receipt sample in the Philippines involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.